The Air Bonsai is a levitating Bonsai Tree. https://t.co/Dnu2T8w6bw 😮 https://t.co/877YiDq3tP

— Product Hunt (@ProductHunt) January 25, 2016Monday, January 25, 2016

Air Bonsai

Friday, January 22, 2016

How Do You Explain This? Brain Power?

Unbelievable stat on the immense success of #israel from the awesome @jamesdcameron @Accel https://t.co/PFKpLTreZ7 pic.twitter.com/qBzH83lOoa

— The Twenty Minute VC (@twentyminutevc) January 22, 2016Thursday, January 21, 2016

Big Sitting Cash

US firms have $1.9 trillion in cash they're not investing. Why? A fascinating essay on this: https://t.co/zA2Za0zYSv pic.twitter.com/1uRU4NamjH— Clive Thompson (@pomeranian99) January 21, 2016Why Are Corporations Hoarding Trillions?

Collectively, American businesses currently have $1.9 trillion in cash, just sitting around. Not only is this state of affairs unparalleled in economic history, but we don’t even have much data to compare it with, because corporations have traditionally been borrowers, not savers. ....... it is probably earning only about 2 percent interest by parking that money in United States Treasury bonds. These companies would be better off investing in anything — a product, a service, a corporate acquisition — that would make them more than 2 cents of profit on the dollar, a razor-thin margin by corporate standards. And yet they choose to keep the cash. ........ if you buy a share in Alphabet, which has sold for roughly $700 lately, you are effectively buying ownership of more than $100 in cash. ......

General Motors is perhaps the most extreme: It now holds nearly half its value in cash. Apple holds more than a third.

....... If the companies spent their savings, rather than hoarding them, the economy would instantly grow, and we would most likely see more jobs with better pay. ....... the 1990s were a period of low unemployment and high growth. Remarkably, the United States government was able to tax all that productive corporate behavior so much that it came close to paying off all its debts for the first time in 160 years........holding on to cash and carefully shifting it among subsidiaries, especially foreign ones, is a great tool to shrink your tax bill.

....... Google buys about one company a week, on average ..... Companies like Google and GM are holding on to far more cash — many times more — than could possibly be explained by emergency funds and tax efficiencies and M.&A. intimidation put together. ...... finance economists agree that there is a puzzle here ..... a large cash hoard is a sign of an unhealthy company. Maybe its whole industry is doing so poorly that there is nothing worth investing in ....... Corporations, it seems, may have amassed at least a good chunk of that $1.9 trillion in mysterious savings because the stock market is rewarding them for it. ........ both the executives and the investors in these industries believe that something big is coming, but — this is crucial — they’re not sure what it will be. .....Their hoarding of it hints that they think the next transformative innovation could be just around the corner.

These trillions should go into Clean Energy and Global South infrastructure. There will be solid if not sexy returns. A 10% annual growth beats zero. A trillion going into clean energy makes global warming talk mostly history.

Related articles

Hundreds of large firms paying no tax in Australia

Hundreds of large firms paying no tax in Australia Auto Artificial Intelligence $75 Billion Market

Auto Artificial Intelligence $75 Billion Market EU Regulators Continue Investigation Into Apple's Tax Affairs

EU Regulators Continue Investigation Into Apple's Tax Affairs IDC: Apple Watch to Dominate Smartwatch Market Through 2019

IDC: Apple Watch to Dominate Smartwatch Market Through 2019 Apple Watch's dominance isn't slowing down any time soon

Apple Watch's dominance isn't slowing down any time soon IDC expects Apple Watch to dominate wearables market through 2019

IDC expects Apple Watch to dominate wearables market through 2019

@pomeranian99 @pmarca This is like allowing the ocean currents to stop the churn. Bad for the planet.

— Paramendra Bhagat (@paramendra) January 22, 2016Wednesday, January 20, 2016

Computers Create Jobs

Interesting @JamesBessen piece - The Automation Paradox, or why robots often increase the need for people https://t.co/9RbLZet6rO

— Varun Deshpande (@varund7) January 19, 2016The Automation Paradox

When computers start doing the work of people, the need for people often increases.

automation as a cause of the slow recovery from the Great Recession and the “hollowing out of the middle class.” Others see white-collar automation as causing a level of persistent technological unemployment that demands policies that would redistribute wealth.Robot panic is in full swing.

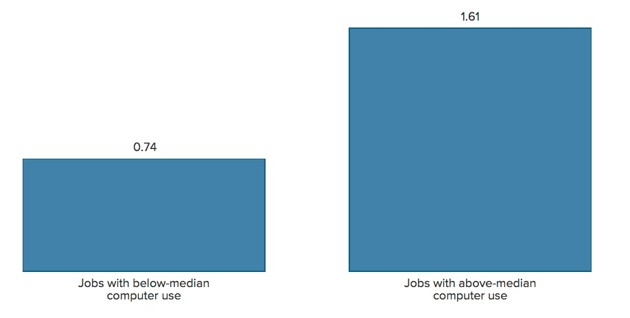

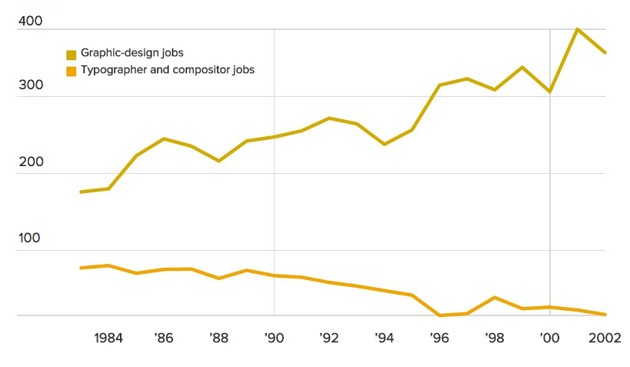

.......... It turns out that workers will have greater employment opportunities if their occupation undergoes some degree of computer automation. As long as they can learn to use the new tools, automation will be their friend. ......... While electronic discovery software has become a billion-dollar business since the late 1990s, jobs for paralegals and legal-support workers actually grew faster than the labor force as a whole, adding over 50,000 jobs since 2000, according to data from the U.S. Census Bureau. The number of lawyers increased by a quarter of a million. ....... Something similar happened when ATMs automated the tasks of bank tellers and when barcode scanners automated the work of cashiers: Rather than contributing to unemployment, the number of workers in these occupations grew. ...... Automation reduces the cost of a product or service, and lower prices tend to attract more customers. Software made it cheaper and faster to trawl through legal documents, so law firms searched more documents and judges allowed more and more-expansive discovery requests. Likewise, ATMs made it cheaper to operate bank branches, so banks dramatically increased their number of offices. So when demand increases enough in response to lower prices, employment goes up with automation, not down. And this is what has been happening with computer automation overall during the last three decades. It’s also what happened during the Industrial Revolution when automation in textiles, steel-making, and a whole range of other industries led to a major increase in manufacturing jobs. ....... desktop publishing systems have meant fewer jobs for typographers, as graphic designers took over their work. Computerized phone lines meant fewer jobs for telephone operators, but more jobs for receptionists ...... Workers with computers frequently substitute for workers in non-computerized jobs. ........ Computers create about as many jobs as they eliminate. In other words, automation is not causing persistent unemployment. ....... only about 5 percent of jobs are at risk of being completely automated in the near future. The main effect of automation for the time being will not be to eliminate jobs, but to redefine them—changing the tasks and the skills needed to perform them. ..... bank tellers have become more like marketing specialists, telling customers about bank loans, CDs, and other financial offerings. .....the jobs that get transferred to other occupations tend to be predominantly low-pay, low-skill jobs, so the burdens of automation fall most heavily on those least able and least equipped to deal with it

..... some community colleges are collaborating with local employers to create work-study programs that allow trainees to learn on the job as well as in the classroom ..... These are the kinds of policies that can help overcome the real burden of automation. They deserve more attention than any panic about a supposed robot apocalypse.

The Enhanced Human

Exoskeletons, bionic limbs/sight... The 'enhanced human' is nigh. Good graphic from @ft.

https://t.co/shnMF1d5Ka pic.twitter.com/LXLu4d7D5m

— Subrahmanyam KVJ (@SuB8u) January 20, 2016Bionic advances to defeat death

People have long dreamt of extending the human lifespan from the biblical “three score years and 10” (70) to reach Methuselah’s 969 and beyond. ....... In reality, average life expectancy in biblical times was not 70 but about 35 years. In Britain this rose to about 50 in 1900, 76 in 1990 and 82 today. ...... Ageing is such a complex biochemical process that there is no simple route to a healthy life lasting well past 100 years old. ...... Individual organs or parts of our body can also be enhanced or rejuvenated to counteract failures due to age or disease.

Subscribe to:

Posts (Atom)