US firms have $1.9 trillion in cash they're not investing. Why? A fascinating essay on this: https://t.co/zA2Za0zYSv pic.twitter.com/1uRU4NamjH— Clive Thompson (@pomeranian99) January 21, 2016Why Are Corporations Hoarding Trillions?

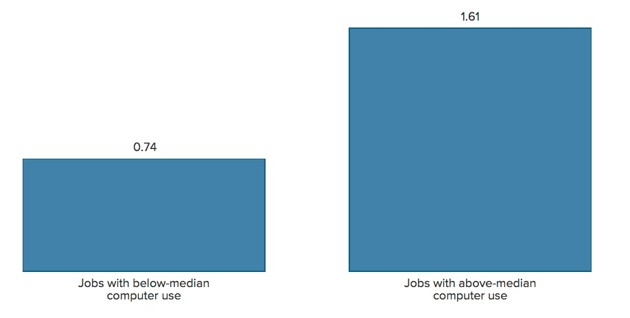

Collectively, American businesses currently have $1.9 trillion in cash, just sitting around. Not only is this state of affairs unparalleled in economic history, but we don’t even have much data to compare it with, because corporations have traditionally been borrowers, not savers. ....... it is probably earning only about 2 percent interest by parking that money in United States Treasury bonds. These companies would be better off investing in anything — a product, a service, a corporate acquisition — that would make them more than 2 cents of profit on the dollar, a razor-thin margin by corporate standards. And yet they choose to keep the cash. ........ if you buy a share in Alphabet, which has sold for roughly $700 lately, you are effectively buying ownership of more than $100 in cash. ......

General Motors is perhaps the most extreme: It now holds nearly half its value in cash. Apple holds more than a third.

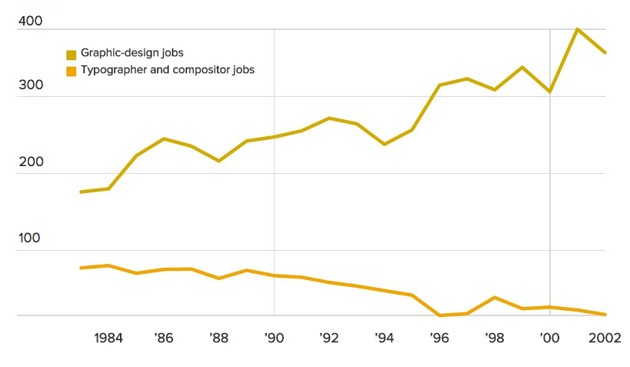

....... If the companies spent their savings, rather than hoarding them, the economy would instantly grow, and we would most likely see more jobs with better pay. ....... the 1990s were a period of low unemployment and high growth. Remarkably, the United States government was able to tax all that productive corporate behavior so much that it came close to paying off all its debts for the first time in 160 years........holding on to cash and carefully shifting it among subsidiaries, especially foreign ones, is a great tool to shrink your tax bill.

....... Google buys about one company a week, on average ..... Companies like Google and GM are holding on to far more cash — many times more — than could possibly be explained by emergency funds and tax efficiencies and M.&A. intimidation put together. ...... finance economists agree that there is a puzzle here ..... a large cash hoard is a sign of an unhealthy company. Maybe its whole industry is doing so poorly that there is nothing worth investing in ....... Corporations, it seems, may have amassed at least a good chunk of that $1.9 trillion in mysterious savings because the stock market is rewarding them for it. ........ both the executives and the investors in these industries believe that something big is coming, but — this is crucial — they’re not sure what it will be. .....Their hoarding of it hints that they think the next transformative innovation could be just around the corner.

These trillions should go into Clean Energy and Global South infrastructure. There will be solid if not sexy returns. A 10% annual growth beats zero. A trillion going into clean energy makes global warming talk mostly history.

@pomeranian99 @pmarca This is like allowing the ocean currents to stop the churn. Bad for the planet.

— Paramendra Bhagat (@paramendra) January 22, 2016