Facebook has taken a public relations beating since 2016. A lot of people blame Facebook for Trump.

There are serious privacy and security issues that the entire sector of tech needs to address. 5G is so promising, but one major line of attack on Huawei has been to do with privacy and security.

But tomorrow is not going to wait. And of the tech giants - Microsoft, Google, Apple, Amazon, Facebook - looks like Facebook has made the boldest move on the biggest of the next big things: The Blockchain.

Taking banking to the unbanked is a noble goal. They say poverty is a lack of cash. Direct cash to the poorest two billion would eliminate poverty. I am all for it.

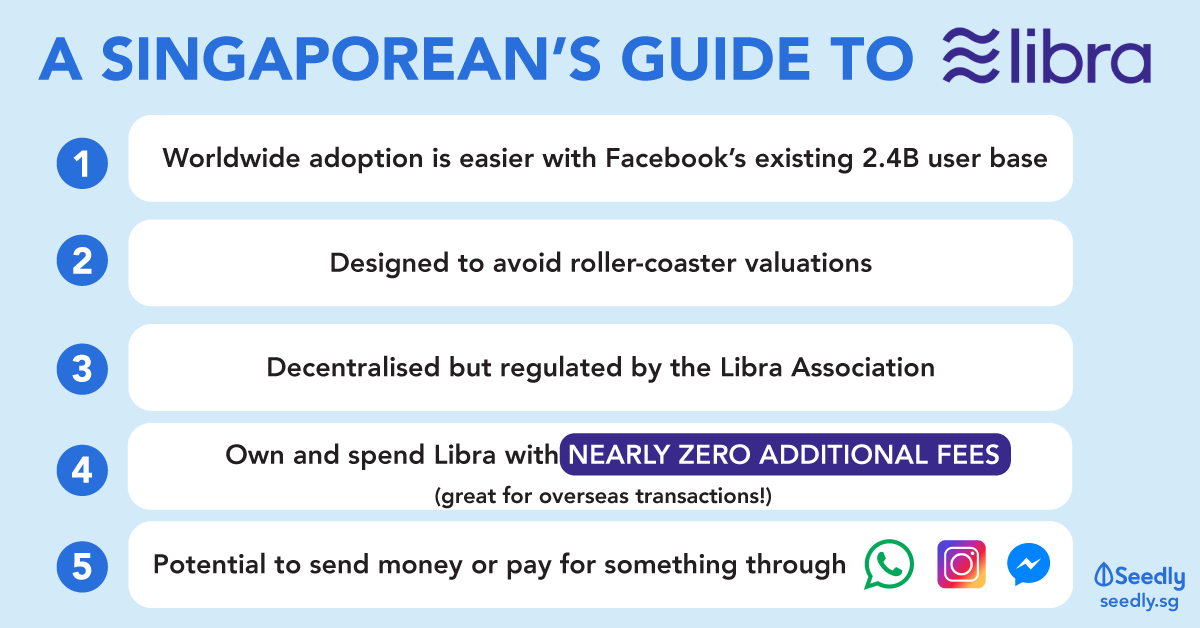

A Libra is like a dollar, or a euro, or a yen, or renminbi. The worth of one Libra likely will be pegged to a basket of all those major currencies. This is something the governments of the world should have long done but never did. That's the first part. The second part is anyone anywhere on the planet will be able to move money as near or as far as they want for zero costs. That's revolutionary. The best use case scenario would be where direct deposits are made into the accounts of the two billion poorest. That is the best way to fight poverty. Poverty is lack of cash. Inject cash.

What Facebook should do next - and I said this years ago - is add a voting feature to its Groups, and a book-keeping feature.

Libra will be governed by a body where Facebook will have only 1% of the vote. Calibra will be a Facebook app, but then anyone else is free to build a Calibra competitor, including the other members of the Big Five.

Bitcoin’s digital gold, but Facebook’s Libra is the digital dollar—here’s why that matters there are some crucial differences between Libra and a cryptocurrency like bitcoin. ....... what Libra is doing is creating a digital version of the U.S. dollar, yen, euro. It’s like a stablecoin, but you still have all the characteristics of a fiat currency ...... With Libra, Facebook users will be able to exchange their dollars for Libra tokens, thus entrusting Facebook and its fellow backers with building a reliable ledger of all transactions ....... Libra users will have to trust the company that has perhaps been most plagued by issues around trust and privacy: Facebook. ...... it’s like the AOL moment: AOL got you online, Libra’s going to get you into crypto

The Senate will hold a hearing next month on Facebook’s Libra currency “Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy,” Brown said yesterday. “We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight. I’m calling on our financial watchdogs to scrutinize this closely to ensure users are protected.”

FACEBOOK’S LIBRA REVEALS SILICON VALLEY’S NAKED AMBITION a comprehensive, borderless economic system for its platform, which is based on a new cryptocurrency, Libra. ....... The company plans to sit ostentatiously on its hands when it comes to governing the project, just one member of the so-called Libra Association, with a total of 28, to emphasize the separation between the currency—which will have a record of your every purchase—and the company ........ whatever scandals may trail the big Silicon Valley companies they are not scaling back, whether that means studying how to eavesdrop on people’s brainwaves to read their minds or building a currency to circumvent borders and national regulation ....... Move fast and break things may have destroyed civic institutions and jeopardized our democracy, but the opposite should be downright scary: Move slow and they break you up. ........ “Libra holds the potential to provide billions of people around the world with access to a more inclusive, more open financial ecosystem,” he said, adding, “We know the journey is just beginning, but together we can achieve Libra’s mission to create a simple global currency and financial infrastructure that will empower billions of people.” ...... spoke of the high fees for transferring money back home, the inefficient requirements of traditional banking, and, most sweepingly, of bringing financial services to the “unbanked” across the far corners of the globe. ......

Libra Quotes we should be able to send money as quickly and securely across borders as we send photos and email. ........... e frictionless commerce for hundreds of millions of people around the world ....... We are committed to ensure that the Internet of

Everything comes with the inclusion of everyone. ........ we know how important it is to promote financial inclusion. We are

committed to developing solutions that are efficient, innovative, and cheap. ...... a new, global digital currency, built on blockchain technology. ....... creating a world without financial borders, where everyone can prosper. ...... Libra has the potential to be one of the most impactful financial innovation opportunities of our time ........ there is an

opportunity to better reach Spotify’s total addressable market, eliminate friction, and enable payments in mass scale. ......... The Libra Association has the potential to significantly expand access to the global economy ........ Sending money to your friend shouldn’t be harder than getting them an Uber ride home. ....... Union Square Ventures has always looked to back platforms that will bring cryptocurrencies to mainstream consumers at scale. Libra is exactly that type of effort, and we look forward to participating in its development and governance. ......... In Digital Societies people should be able to access financial services regardless of where they live or how much they have. ......... This has the potential to be truly transformative and will benefit those who have never used, or are struggling to access, financial services around the world. ....... We are particularly enthusiastic about the potential of Libra’s programming language, Move. Thoughtfully designed smart contracts operating on a widely accessible and stable global currency platform will unlock never-seen-before gains from trade, benefiting society at a meaningful scale. ....... Kiva is focused on addressing the systemic barriers impeding access to financial services for 1.7

billion unbanked individuals around the world. We’re proud to serve as a Founding Partner of the Libra Association and excited by the potential for new technologies to create a more inclusive financial system. ....... More than 1.7 billion people today are financially cut off from the world, with no access to a bank account- a poverty trap that could deepen as the rest of the world becomes ever-more connected. A global digital currency has the potential to spark financial inclusion for the world’s poorest and most vulnerable people, connecting them to the local, national, and global economy ......... Libra has the potential to level the playing field for the 1.7 billion people who remain unbanked and excluded from formal financial services – over half of whom are women! This may be the pivotal moment in time when we look back and recognize we had the key that unlocked the door for billions of people! ....... What we’ve found in almost two decades of work with the financially vulnerable is that when provided with

the right tools, people make good financial decisions. We’ve all read that blockchain is a solution in search of a problem. Financial exclusion and insecurity are clearly problems, both globally and in our home here in the U.S. If a blockchain-based stable cryptocurrency can make a lasting dent in this problem - by offering underserved people critical tools: a stable, secure, convenient place to store and move funds - we should do all we can to understand and explore the opportunity. ....... By simplifying access to the financial transactions that so many of us take for granted, these tools help build resilience and opportunity for the underserved. ....... It represents a highly disruptive step change not just for the cryptocurrency industry, but also for the broader financial system.

Facebook's cryptocurrency Libra aims to 'put the currency back in cryptocurrency' While the “founding members” of Libra include some very big names in payments and commerce—like Visa, MasterCard, PayPal, Stripe, Coinbase, and eBay—many still see the entire project as a Facebook venture, considering the simultaneously coordinated announcements and that Facebook executive David Marcus oversaw the Libra launch. ...... It really is designed to be a unit of purchase and a unit of daily transactions, as opposed to a speculative asset—which is, candidly, where many cryptocurrencies have stood. ...... eventually, when the Libra blockchain launches, it aims to have 100 founding members, with no one member having more than 1% say in the governance.

Bitcoin Faces Technical Hurdle as Libra Steals Crypto Spotlight

Welcome to the official White Paper a new decentralized blockchain, a low-volatility cryptocurrency, and a smart contract platform that together aim to create a new opportunity for responsible financial services innovation. ...... 1.7 billion adults globally remain outside of the financial system with no access to a traditional bank, even though one billion have a mobile phone and nearly half a billion have internet access. ...... All over the world, people with less money pay more for financial services. Hard-earned income is eroded by fees, from remittances and wire costs to overdraft and ATM charges. Payday loans can charge annualized interest rates of 400 percent or more, and finance charges can be as high as $30 just to borrow $100........ We believe that many more people should have access to financial services and to cheap capital. ...... global, open, instant and low-cost movement of money will create immense economic opportunity and more commerce across the world......... people will increasingly trust decentralized forms of governance. ........ a global currency and financial infrastructure should be designed and governed as a public good. ...... the promise of “the internet of money.” ...... Moving money around globally should be as easy and cost-effective as — and even more safe and secure than — sending a text message or sharing a photo, no matter where you live, what you do, or how much you earn. ....... people need to have confidence that they can use Libra and that its value will remain relatively stable over time....... Unlike the majority of cryptocurrencies, Libra is fully backed by a reserve of real assets. A basket of bank deposits and short-term government securities will be held in the Libra Reserve for every Libra that is created, building trust in its intrinsic value. ........ any consumer, developer, or business can use the Libra network, build products on top of it, and add value through their services. ...... The goal of the Libra Blockchain is to serve as a solid foundation for financial services, including a new global currency, which could meet the daily financial needs of billions of people. ....... “Move” is a new programming language for implementing custom transaction logic and “smart contracts” on the Libra Blockchain. Because of Libra’s goal to one day serve billions of people, Move is designed with safety and security as the highest priorities. ......... We believe that the world needs a global, digitally native currency that brings together the attributes of the world’s best currencies: stability, low inflation, wide global acceptance, and fungibility. ..... anyone with Libra has a high degree of assurance they can convert their digital currency into local fiat currency based on an exchange rate, just like exchanging one currency for another when traveling. ....... will be backed by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks......... the ability to send money quickly, the security of cryptography, and the freedom to easily transmit funds across borders. Just as people can use their phones to message friends anywhere in the world today, with Libra, the same can be done with money — instantly, securely, and at low cost.......... success will mean that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee.