The Man Behind Ethereum Is Worried About Crypto's Future . Vitalik Buterin, the most influential person in crypto ....... He doesn’t drink or particularly enjoy crowds. ...... the 28-year-old creator of Ethereum to celebrate. Nine years ago, Buterin dreamed up Ethereum as a way to leverage the blockchain technology underlying Bitcoin for all sorts of uses beyond currency ........ Ether, the platform’s native currency, has become the second biggest cryptocurrency behind Bitcoin, powering a trillion-dollar ecosystem that rivals Visa in terms of the money it moves. Ethereum has brought thousands of unbanked people around the world into financial systems, allowed capital to flow unencumbered across borders, and provided the infrastructure for entrepreneurs to build all sorts of new products, from payment systems to prediction markets, digital swap meets to medical-research hubs. ........ Ethereum has made a handful of white men unfathomably rich, pumped pollutants into the air, and emerged as a vehicle for tax evasion, money laundering, and mind-boggling scams. “Crypto itself has a lot of dystopian potential if implemented wrong,” the Russian-born Canadian explains the morning after the party in an 80-minute interview in his hotel room. .......... Buterin hopes Ethereum will become the launchpad for all sorts of sociopolitical experimentation: fairer voting systems, urban planning, universal basic income, public-works projects. Above all, he wants the platform to be a counterweight to authoritarian governments and to upend Silicon Valley’s stranglehold over our digital lives. But he acknowledges that his vision for the transformative power of Ethereum is at risk of being overtaken by greed. .......... has left Buterin reliant on the limited tools of soft power: writing blog posts, giving interviews, conducting research, speaking at conferences ....... “I’ve been yelling a lot, and sometimes that yelling does feel like howling into the wind”

......... The war is personal to Buterin, who has both Russian and Ukrainian ancestry. He was born outside Moscow in 1994 to two computer scientists ........ At 4, he inherited his parents’ old IBM computer and started playing around with Excel spreadsheets. At 7, he could recite more than a hundred digits of pi, and would shout out math equations to pass the time. By 12, he was coding inside Microsoft Office Suite. The precocious child’s isolation from his peers had been exacerbated by a move to Toronto in 2000, the same year Putin was first elected. His father characterizes Vitalik’s Canadian upbringing as “lucky and naive.” Vitalik himself uses the words “lonely and disconnected.” ........ Vitalik soon began writing articles exploring the new technology for the magazine Bitcoin Weekly, for which he earned 5 bitcoins a pop (back then, some $4; today, it would be worth about $200,000). ..... At 18, he co-founded Bitcoin Magazine and became its lead writer, earning a following both in Toronto and abroad. “A lot of people think of him as a typical techie engineer,” says Nathan Schneider, a media-studies professor at the University of Colorado, Boulder, who first interviewed Buterin in 2014. “But a core of his practice even more so is observation and writing—and that helped him see a cohesive vision that others weren’t seeing yet.” ........ The blockchain, he thought, could serve as an efficient method for securing all sorts of assets: web applications, organizations, financial derivatives, nonpredatory loan programs, even wills. Each of these could be operated by “smart contracts,” code that could be programmed to carry out transactions without the need for intermediaries. A decentralized version of the rideshare industry, for example, could be built to send money directly from passengers to drivers, without Uber swiping a cut of the proceeds. ....... In 2013, Buterin dropped out of college and wrote a 36-page white paper laying out his vision for Ethereum: a new open-source blockchain on which programmers could build any sort of application they wished. .......... Within months, a group of eight men who would become known as Ethereum’s founders were sharing a three-story Airbnb in Switzerland, writing code and wooing investors. ........ The ensuing conflicts left Buterin with culture shock. In the space of a few months, he had gone from a cloistered life of writing code and technical articles to a that of a decisionmaker grappling with bloated egos and power struggles. ........ Buterin still does not present stereotypical leadership qualities when you meet him. He sniffles and stutters through his sentences, walks stiffly, and struggles to hold eye contact. He puts almost no effort into his clothing ....... Buterin is wryly funny and almost wholly devoid of pretension or ego. He’s an unabashed geek whose eyes spark when he alights upon one of his favorite concepts, whether it be quadratic voting or the governance system futarchy. Just as Ethereum is designed to be an everything machine, Buterin is an everything thinker, fluent in disciplines ranging from sociological theory to advanced calculus to land-tax history. (He’s currently using Duolingo to learn his fifth and sixth languages.) He doesn’t talk down to people, and he eschews a security detail. ....... Alexis Ohanian, the co-founder of Reddit and a major crypto investor, says being around Buterin gives him “a similar vibe to when I first got to know Sir Tim Berners-Lee,” the inventor of the World Wide Web. “He’s very thoughtful and unassuming,” Ohanian says, “and he’s giving the world some of the most powerful Legos it’s ever seen.” ............ There was the ICO boom of 2017, in which venture capitalists raised billions of dollars for blockchain projects. There was DeFi summer in 2020, in which new trading mechanisms and derivative structures sent money whizzing around the world at hyperspeed. And there was last year’s explosion of NFTs: tradeable digital goods, like profile pictures, art collections, and sports cards, that skyrocketed in value. ........ Proof of Humanity, which awards a universal basic income—currently about $40 per month—to anyone who signs up. ...... Inequities have crept into crypto in other ways, including a stark lack of gender and racial diversity. ........ frustrated users are decamping to newer blockchains like Solana and BNB Chain, driven by the prospect of lower transaction fees, alternative building tools, or different philosophical values. ........ On his blog and on Twitter, you’ll find treatises on housing; on voting systems; on the best way to distribute public goods; on city building and longevity research. ........ His blog is a model for how a leader can work through complex ideas with transparency and rigor, exposing the messy process of intellectual growth for all to see, and perhaps learn from. .......... He sees the technology as the most powerful equalizer to surveillance technology deployed by governments (like China’s) and powerful companies (like Meta) alike.

.

Crypto Cities

Update on ResearchHub and ResearchCoin

What will happen to cryptocurrency in the 2020s . I think over the next decade we’ll see a blockchain, that is both more scalable and includes privacy features, reach about 1B users by the end of the decade (up from about 50M at the start of the decade). Adoption will happen both in emerging markets, where the financial systems are most broken ........ By the end of the decade, most tech startups will have a crypto component, just like most tech startups use the internet and machine learning today. Governments and institutions will move into the cryptocurrency space in a big way as well. ........ Once we see blockchains with several orders of magnitude scalability improvements, we will also see new applications start to develop more rapidly ........ we’ll eventually see a “privacy coin” or blockchain with built in privacy features get mainstream adoption ........ the best new companies that get created in the crypto space in the 2020’s will be about driving the utility phase (people using crypto for non-trading purposes) ....... they will bring together global communities and marketplaces at a pace we have never seen before in traditional startups (which have to painfully expand country by country, integrating each country’s payment methods and regulations one at a time). There are myriad regulatory questions that this will open up, but the advantages are so strong, I think the market will find a way. ...... The next 100M people who get exposure to cryptocurrency will not come from them caring about cryptocurrency, but because they are trying to play some game, use a decentralized social network, or earn a living, and using cryptocurrency is the best/only way to use that particular application.

.......... the other area of adoption will be in emerging markets where the existing financial systems are a much bigger pain point. In particular, countries with high inflation rates and large remittance markets where crypto can really shine ....... we will see cryptocurrency adoption in emerging markets scale to hundreds of millions of users, with at least one country “tipping” so that the majority of transactions in their economy happen in cryptocurrency. ........ We’ve already started to see small institutions enter the cryptocurrency space. Hundreds have joined Coinbase Custody in the past 18 months. I would expect this rapid growth to continue in 2020, with larger and larger institutions coming on board. Eventually just about every financial institution will have some sort of cryptocurrency operation, and most funds will keep a portion of their assets in cryptocurrencies, because of the uncorrelated returns and upside potential. Something like 90% of the money in the world is locked up in institutions, so this will likely drive a lot of demand for crypto assets. ........... China took the initiative by beginning to digitize the yuan ....... we will then see basket digital currencies come out ....... During the last decade, many of the companies we think of as cryptocurrency exchanges were actually brokerages, exchanges, custodians, and clearing houses bundled into one. During the 2020’s I think we’ll see the cryptocurrency market structure evolve to more closely resemble the traditional financial world ......... Many of the apps and non-custodial wallets in this world, since they never store customer funds, will be regulated like software companies instead of financial service companies. This will dramatically accelerate the pace of innovation and make them inherently global from day one ...... As the decentralized cryptoeconomy grows, more people will earn a living in crypto and feel a sense of empowerment, much like early immigrants coming to America. .......... Olaf Carlson-Wee and Balaji Srinivasan estimate that at a price of $200,000 per Bitcoin, more than half the world’s billionaires will be from cryptocurrency

. .......... By shifting cryptocurrency from being primarily about trading and speculation to being about real world utility, the 2020s will see a huge increase in the number of people holding and using cryptocurrency, and start to really move the needle on global economic freedom. .

What happened in crypto over the last decade . It was December of 2010 when I first read the Bitcoin whitepaper, while at home visiting my parents for the holidays. ........ this post is inspired by Fred Wilson’s post for tech more broadly ....... throughout much of the decade, it was a frequently debated question about whether Bitcoin would even survive ..... Not only did Bitcoin survive, it thrived, becoming the top performing asset of the decade. ......... most big breakthroughs are contrarian ideas that people dismiss and ridicule at the start. ........ For a new industry, there was a lot of infighting as protocol changes were debated and new coins were launched (via fork, or entirely new projects). Many groups became radicalized, and splintered off into their own echo chamber. ......... The industry went through a period of five bubbles, followed each time by a crash (settling at a higher point than the previous low). In other words, the industry kept growing in an upward channel, but it was a very bumpy ride. This meant that a lot of the discussion and media attention was on the price of crypto, and the day trading attracted short term thinking that bordered at times on gambling. At the same time, investors who took a long term approach (for example, by dollar cost averaging into a position over multiple years) saw incredible returns. Bitcoin was the highest performing asset of the decade, beating out even the top unicorns, growing to more than $100B in market cap. By the end of the decade, it became common place for astute investors to hold 1–10% of their net worth in cryptocurrency, as part of a diversified portfolio. .......... Defi seems to be one use case that has worked

, even at the limited scale of today’s blockchains, because borrowing and lending requires lower transaction throughput versus say a game or social network. .......... trading and speculation were the predominant use case for crypto in the past decade, and the utility phase took longer than many expected. ......... now 8 out of the top 10 largest crowdfunding projects of all time are crypto related ........ The ICO trend attracted the ire and attention of the SEC ..... the best business models in the past decade in crypto tended to be exchanges and brokerages who sold shovels during the gold rush to trade this new asset class ......... our own small fund, Coinbase Ventures, has invested in 60 crypto startups in the last few years ....... the “blockchain not bitcoin” mindset that is more common amongst banks and governments ............. (fun fact: the big three, Paradigm, Polychain, and A16Z Crypto, were all founded by former Coinbase employees or board members). ............ hundreds of institutional clients onboard to Coinbase Custody, which grew from $0 to $7B AUM in the last 18 months, making it the largest crypto custodian in the world for institutions. .......... Coinbase was (as far as I know) the first crypto company to really take regulation seriously because we felt it would increase adoption long term ........ At the close of this decade, I can confidently say that that cryptocurrency is a regulated industry (at least in first world countries), although it will continue to evolve rapidly. During this past decade, there was a big open question about whether crypto would be regulated as a currency, commodity, security, property, or something else entirely. As various times, the IRS, SEC, CFTC, NYDFS, FinCEN, and others all put out guidance (and this was just in the U.S.). Regulators in Singapore, Switzerland, and the Caymans all became quite sophisticated on crypto, and started to attract great startups to incorporate there. As it turned out, there was no one solution to how cryptocurrency was going to be regulated, because there were so many different types of cryptocurrencies! At some point, everyone realized we were recreating just about every portion of the existing financial system, and this would require many different types of regulators. .

Bringing DeFi to the World . DeFi tools are censorship-resistant, unbiased, and available to anyone with a smartphone. That’s why for this winter’s hackathon, we focused on bringing DeFi to the world. ......... For the Coinbase winter 2019 hackathon, over 250 Coinbase employees submitted 51 ideas—ultimately demoing 31 projects—all focused around how to bring DeFi to the world. ......... decentralized autonomous organization, also known as a DAO

........ To keep things fun and innovative, Coinbase hackathons allow Coinbase employees to explore a wide variety of concepts outside the confines of placing products into production. None of the products or services described in this blog post are in production or are otherwise available to the public, or represent any plan by Coinbase to do so. .

What Happened In The 2010s . The emergence of the big four web/mobile monopolies; Apple, Google, Amazon, and Facebook. ........ these four companies own monopolies or duopolies in their core markets and are using the power of those market positions to extend their reach into tangential markets and beyond. ........ Facebook built and acquired its way into owning four of the most strategic social media properties in the world; Facebook, Instagram, Messenger, and WhatsApp. Most importantly, outside of China, these four companies own more data about what we do online and also control many of the important channels to reach us in the digital world. What society does about this situation stands as the most important issue in tech at the start of the 2020s. ....... The massive experiment in using capital as a moat to build startups into sustainable businesses has now played out and we can call it a failure for the most part. Uber popularized this strategy and got very far with it, but sitting here at the end of the 2010s, Uber has not yet proven that it can build a profitable business, is struggling as a public company, and will need something more than capital to sustain its business. WeWork was a fast follower with this strategy and failed to get to the public markets and is undergoing a massive restructuring that will determine the fate of that business. Many other experiments with this model have failed or are failing right now. ............. Accumulating a data asset around your product and service and using sophisticated machine learning models to personalize and improve your product is not a nice to have. It is a must have. This ultimately benefits the three large cloud providers (Amazon, Google, Microsoft) who are providing much of the infrastructure to the tech industry to do this work at scale, which is how you must do it if you want to be competitive. .......... Subscriptions became the second scaled business model for web and mobile businesses, following advertising which emerged at scale in the previous decade. .. However, as we end the decade, a subscription overload backlash is emerging as many consumers have signed up for more subscriptions than they need and in some cases can afford. ........ Silicon Valley’s position as mecca for tech and startups started to show signs of weakening in the 2010s, largely because of its massive successes this decade. It is incredibly expensive to live and work in the bay area and the quality of life/cost of life equation is not moving in the right direction ....... other tech sectors will find an easier time recruiting talent to their regions and away from Silicon Valley. And talent is really the only thing that matters these days. .......... The emergence of Bitcoin and decentralized money this decade has shown the way and set the stage for cryptography to be built natively into web and mobile applications and deliver control back to users.

........ Technology inserted itself right in the middle of society this decade. Our President wakes up and fires off dozens of tweets, possibly while still in bed. ......... “The rich in already rich countries plus an increasing number of superrich in the developing world … captured an astounding 27% of global growth.” ..... The rate of extreme poverty around the world was cut in half over the past decade (15.7% in 2010 to 7.7% now), and all but eradicated in China. ....... Many of the superrich obtained their wealth through technology business interests. Some of the eradication of extreme poverty is the result of technology as well. And the stagnation of earning power in the lower and middle class is absolutely the result of technology automation, a trend that will only accelerate in coming years. ........ the emergence of China as a tech superpower and a global superpower. .

Welcome Surojit Chatterjee, Coinbase’s Chief Product Officer . after spending 11 years at Google. ...... Most recently, Surojit was Vice President of Product at Google, where he led Google Shopping, which helps people discover and compare products on Google. Before leading Google Shopping, Surojit was the Head of Product at Flipkart, a popular Indian e-commerce site, leading product management, user experience, product operations, and data science. Prior to Flipkart, Surojit was a founding member of Google’s mobile search ads product. ........ Surojit’s 11 years at Google will be valuable as we continue to scale Coinbase into a company with a lasting and meaningful impact on the world’s financial system. But his experience leading Flipkart — an exciting startup in one of the world’s fastest-growing markets — arguably provided him an even closer look at the complexity and inefficiency of global commerce. When someone has only lived, worked, or transacted in a country like the United States, it can be difficult to grasp the size of the opportunity in simplifying cross-border transactions. But it’s clear that Surojit’s insights and experiences on the front lines of global commerce make him the perfect person to lead our product organization, help us continue our pace of repeatable innovation, and bring Coinbase products to the next billion crypto users around the world . ........ he sees how “cryptocurrencies and blockchain technology can help open up the financial system for everyone by growing cross-border commerce, lowering transaction costs, providing higher security and by helping individuals have more control over their financial future.” .

How MakerDAO doubled its users in a single weekend using Coinbase Earn . On July 26, 2019, Coinbase Earn launched the Dai Advanced Task. In a few days, users created more CDPs (Collateralized Debt Positions) than ever existed. In the previous 11 months, about 9,000 CDPs were created on the blockchain with MakerDAO. We chose to launch on a Friday. On the weekend after the Dai Advanced Task began, over 10,000 CDPs were created. ....... Coinbase Earn is a platform that connects the community of users with foundations like MakerDAO. The product allows users to earn cryptocurrencies while learning about them by watching educational videos and doing tasks. ........ MakerDAO is one of the most popular decentralized apps in the crypto community. It allows users to use ETH as collateral and create CDP’s in a stablecoin called DAI. DAI is made stable with the help of smart contracts on the Ethereum network, keeping it very closely pegged to the US Dollar. ......... Users of decentralized finance have a fear of losing their initial deposits if they type in the wrong receiving address. Furthermore, many of the current user interfaces are notoriously difficult to use since they’re intended for engineers with technical experience and not consumers. ......... The DAI Advanced lesson has been a huge success for token development teams and for our community of users. By completing this task, many users directly engaged with a blockchain for the first time. .

A Beginner’s Guide to Decentralized Finance (DeFi) . Cryptocurrency’s promise is to make money and payments universally accessible– to anyone, no matter where they are in the world. ........ Imagine a global, open alternative to every financial service you use today — savings, loans, trading, insurance and more — accessible to anyone in the world with a smartphone and internet connection. .......... This is now possible on smart contract blockchains, like Ethereum. “Smart contracts” are programs running on the blockchain that can execute automatically when certain conditions are met. These smart contracts enable developers to build far more sophisticated functionality than simply sending and receiving cryptocurrency. These programs are what we now call decentralized apps, or dapps. .......... You can think of a dapp as an app that is built on decentralized technology, rather than being built and controlled by a single, centralized entity or company. ......... While some of these concepts might sound futuristic–automated loans negotiated directly between two strangers in different parts of the world, without a bank in the middle– many of these dapps are already live today. There are DeFi dapps that allow you to create stablecoins (cryptocurrency whose value is pegged to the US dollar), lend out money and earn interest on your crypto, take out a loan, exchange one asset for another, go long or short assets, and implement automated, advanced investment strategies. ......... At their core, the operations of these businesses are not managed by an institution and its employees — instead the rules are written in code (or smart contract, as mentioned above). Once the smart contract is deployed to the blockchain, DeFi dapps can run themselves with little to no human intervention (although in practice developers often do maintain the dapps with upgrades or bug fixes). ........... Dapps are designed to be global from day one — Whether you’re in Texas or Tanzania, you have access to the same DeFi services and networks. .......... “Permissionless” to create, “permissionless” to participate — anyone can create DeFi apps, and anyone can use them. Unlike finance today, there are no gatekeepers or accounts with lengthy forms. ........... don’t like the interface to a certain dapp? No problem — you can use a third party interface, or build your own ....... Interoperable — new DeFi applications can be built or composed by combining other DeFi products like Lego pieces — e.g. stablecoins, decentralized exchanges, and prediction markets can be combined to form entirely new products. ....... DeFi is now one of the fastest growing sectors in crypto.

Industry observers measure traction with a unique new metric — “ETH locked in DeFi”. At the time of writing, users have deposited over $600 million worth of crypto into these smart contracts. ....... Like any computer code, smart contracts can be vulnerable to both unintended programming mistakes and malicious hacks. ........... each stablecoin (called DAI) is pegged to the US Dollar and is backed by collateral in the form of crypto ........ Maker is more than just a stablecoin project, though–it aspires to be a decentralized reserve bank. ........ Money and finance have been around in one form or the other since the dawn of human civilization. Crypto is just the latest digital avatar. ......... In upcoming years, we might see every financial service that we use in today’s fiat system being rebuilt for the crypto ecosystem. ........ The first generation of DeFi dapps rely heavily on collateral as a safeguard. That is, you need to already own crypto and provide it as collateral in order to borrow more crypto. More traditional unsecured borrowing and lending will need to rely on an identity system, so that borrowers can build up credit and increase their borrowing power, much like today’s SSN and FICO scores. Unlike today’s identity and credit systems however, a decentralized identity will have to be both universal and privacy-preserving........... If a hacker finds and exploits a bug in the open source code for a dapp, millions of dollars could be drained in an instant. Teams like Nexus Mutual are building decentralized insurance that would make users whole in the event of smart contract hacks............. we expect that crypto wallets will be the portal to all your digital asset activity, just like an internet browser today is your portal to the world’s news and information ......... The DeFi space will at first play catch up with today’s financial services industry. But over time, it’s hard to even fathom what innovations will come about when the power to build financial services is democratized to anyone who can write code. .

Bringing DeFi to the World .DeFi tools are censorship-resistant, unbiased, and available to anyone with a smartphone. .

Coinbase is a mission focused company . Coinbase has had its own challenges here, including employee walkouts. ........ I want Coinbase to be laser focused on achieving its mission, because I believe that this is the way that we can have the biggest impact on the world. We will do this by playing as a championship team, focus on building, and being transparent about what our mission is and isn’t. ....... Sustained high performance: As compared to a family, where everyone is included regardless of performance, a championship team makes a concerted effort to raise the bar on talent, including changing out team members when needed. ........ There are many places that a company can choose to allocate its limited time and resources. There is never enough time to do everything, so companies need to choose what change they want to see in the world and focus there. It can take decades to move the needle on large global challenges. ........ At Coinbase, we say that we are focused on building. What does this mean? It means we are going to focus on being the best company we can be, and making progress toward our mission, as compared to broader societal issues. ....... Build great products: The vast majority of the impact we have will be from the products we create, which are used by millions of people. ...... Source amazing talent: We create job opportunities for top people, including those from underrepresented backgrounds who don’t have equal access to opportunities, with things like diverse slates (Rooney rule) on senior hires, and casting a wide net to find top talent. ......... Fair talent practices: We work to reduce unconscious bias in interviews, using things like structured interviews, and ensure fair practices in how we pay and promote. We have a pay for performance culture, which means that your rewards and promotions are linked to your overall contribution to the mission and company goals. ........... Enable belonging for everyone: We work to create an environment where everyone is welcome and can do their best work, regardless of background, sexual orientation, race, gender, age, etc. .......... Policy decisions: If there is a bill introduced around crypto, we may engage here, but we normally wouldn’t engage in policy decisions around healthcare or education for example. ........ Non-profit work: We will do some work here with our Pledge 1% program and GiveCrypto.org, but this is about 1% of our efforts. We are a for-profit business. When we make profit, we can use that to hire more great people, and build even more. We shouldn’t ever shy away from making profit, because with more resources we can have a greater impact on the world. ............ Broader societal issues: We don’t engage here when issues are unrelated to our core mission, because we believe impact only comes with focus. ......... Political causes: We don’t advocate for any particular causes or candidates internally that are unrelated to our mission, because it is a distraction from our mission. Even if we all agree something is a problem, we may not all agree on the solution. ........ we want all employees to feel safe disagreeing on the work itself. Candor and debate are core to a healthy team, where it is safe to disagree. We consider these to be related to our mission. ........ We’ve seen what internal strife at companies like Google and Facebook can do to productivity ........ Change happens in the world only when a smart, talented, group of people come together to focus on a hard problem for a decade or more. Many companies never stand the test of time, because they decide to dabble in unrelated efforts, and distract and divide their workforce in the process. Paradoxically, by being laser focused on our mission, we will likely have an even greater impact on the world, through our products and growing customer base. .......... We could use our work day debating what to do about various unrelated challenges in the world, but that would not be in service of the company or our own interests as employees and shareholders. ......... Coinbase’s mission is to create an open financial system for the world. This means we want to use cryptocurrency to bring economic freedom to people all over the world. This is difficult and important work, and every employee at Coinbase signed up because they are excited about this mission. ....... Some people interpreted the mission more broadly, to include all forms of equality and justice. It makes sense if you believe that economic freedom is not possible without equality for all people. Others interpreted the mission more narrowly, believing that we were trying to create infrastructure for the cryptoeconomy, and that yes, this would create more equality of access for all people, but we weren’t trying to solve all forms of inequality in the world. ........ I don’t think companies can succeed trying to do everything. Creating an open financial system for the world is already a hugely ambitious mission, and we could easily spend the next decade or two trying to move the needle on global economic freedom. We will keep building the most trusted and easiest to use financial products that help people access the cryptoeconomy, so everyone can get the benefits of this new technology and we can bring more economic freedom to the world. ........... for some employees, working at an activism focused company may be core to what they want, and we want to prompt that conversation with their manager to help them get to a better place ......... These are difficult times, and every CEO I know is trying to figure out how to lead through it. ......... We are an intense culture and we are an apolitical culture. We’re also committed to making Coinbase a place that creates incredible job opportunities and a welcoming environment for people of every age, race, gender, sexual orientation, etc. .

A follow up to Coinbase being a mission focused company . about 5% of employees (60) have decided to take the exit package ........ We’ll continue to keep a close eye on this to ensure we are building a diverse, inclusive environment where everyone feels they belong. ........ we support each other through tough times and also have conversations about recent events like any team. We have just made a decision to not engage in broader activism as a company outside of our mission. ......... I’m excited to be moving forward as #OneCoinbase to pursue our vision of economic freedom for every person and business. .

Culture at Coinbase . Some of these ideas are more aspirational than others, meaning they represent where we would like to be, not necessarily where we are today. Our goal as a team is to continually get closer to this ideal. ......... our four company values ........ Our values are deeply ingrained in our culture and are important guideposts for how we work, hire, develop, and promote. With this update, there is now a single document describing how we work at Coinbase and what we value in our people. ........... and inspire other companies who are working to build unique cultures of their own. ...... We are direct and succinct. We share information efficiently, improving collaboration and productivity. We practice active listening. ........ We have a bias for action. We complete high quality work quickly. We focus on the 20% of work that will get us 80% of the impact. ........ We take 100% responsibility for achieving the mission. We seek to improve all aspects of our company even in ways that are not explicitly part of our job. We run through brick walls. ........ We take extraordinary measures to have exceptional people in every seat. We ask whether each candidate will raise the average on the team before making an offer. We cast a wide net, to attract candidates from every background, focusing on both skill and culture alignment. We actively coach and develop. Unremarkable performance gets a generous severance package. ......... We are a winning team, not a family, and have high expectations for performance and delivering results. We’re stronger together so we choose to focus on what unites us, and not what divides us. We have an intense work culture, and are regularly pushed out of our comfort zones. We take rest seriously, to improve productivity over the long term. Coinbase should continually earn employees’ commitment and, likewise, expects employees to earn their seat at the company. ............. We’re humble, and value learning over being right. We embrace delivering and receiving candid feedback, and see every setback as an opportunity to learn. ........... We are deeply focused on solving our customers’ problems with technology, by enabling them to acquire, store and use crypto. We strive to be the easiest to use, most trusted and most secure platform.

In every decision we make, we ask, “How does this create more value for our customers?” .............. We are builders, leveraging technology to improve the world, constantly shipping ideas vs just discussing them. We know that companies must continually reinvent themselves to avoid stagnation. We have a high tolerance for failure, investing 10% of our resources in venture bets that are uncomfortably ambitious. ........ We are optimistic about the future and determined to get there. We co-create solutions instead of choosing blame and criticism. ......... Our mission is ambitious and important. We don’t engage in social or political activism that is unrelated to our mission while at work. We seek to make the workplace a refuge from division, so we can stay focused on making progress toward the mission. .

Our Mission, Strategy and Culture From the earliest days I built Coinbase to harness the power of cryptocurrency and create more freedom in the world. Five years ago we codified this into the first version of our vision, mission and strategy, the top level objectives that our products and goals align to. ...... Every few years we take another look and see if we can improve the communication of these core tenets. Why? Because they inform almost every decision we make at Coinbase. .......... Our mission is to increase economic freedom in the world.

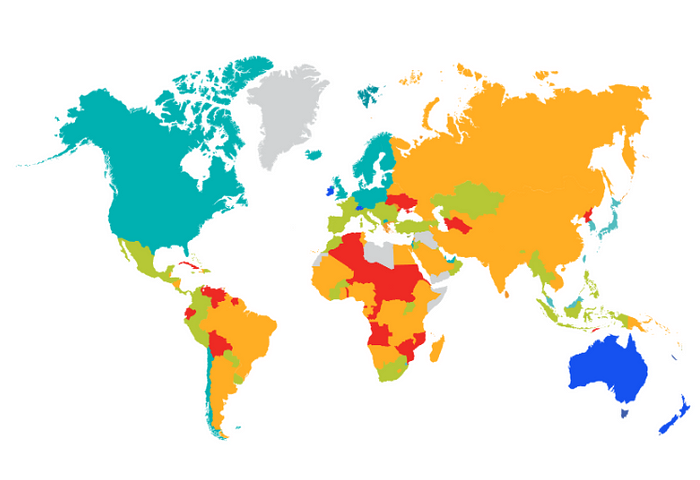

.......... Why economic freedom? Economic freedom is a global indicator that is clearly defined and has been measured for decades. It is a composite metric, assessed both globally and for every country, that looks at a variety of factors like property rights, stability of currency, ability to start the business you want and work where you want, free trade, corruption, etc. ........... Higher economic freedom correlates with the kind of societies that we all aspire to create. ........ When I first read the Bitcoin whitepaper back in 2010, I realized this computer science breakthrough might be the key to creating more economic freedom. The current financial system is rife with high fees, delays, unequal access, and barriers to innovation. ............. In many countries, citizens don’t have access to sound money, a functioning credit system, or even basic property rights. I realized that we could use cryptocurrency to create sound financial infrastructure in every country around the world. .......... outlined the four phases I envisioned cryptocurrency going through on its path to reaching 1 billion users. We have made incredible progress towards this plan, with >50M verified users on Coinbase, and more using other crypto products. ......... Investing is the first use case for every crypto holder and user, and we are the world’s most trusted onramp . ......... building out the critical infrastructure and prime brokerage services to bring access to crypto markets to institutions of all sizes. .......... crypto companies and protocol teams are driving new innovations and products beyond financial use cases ......... building a world class company starts with building a high performing team. Our #1 priority is attracting and retaining top talent .

Building Crypto Out of India .There’s never been a more exciting time for builders working in crypto. This is true worldwide, but especially in India which is seeing a boom in crypto-native talent and in creating and growing important crypto projects — Polygon and Instadapp to name just a couple. It is of course well known that India has a vibrant, world class community of software engineers, technology builders and entrepreneurs. To add to this, we have been pleasantly surprised at the growing expertise in crypto and blockchain technologies as well. .......... we are proud to say that each of these new hires is and will be among the topmost talent available anywhere in the world. ........ Coinbase is an ambitious and fast-moving company. As we build our presence in India from scratch, this is an incredible opportunity to work in a start-up-like, fast growing environment. ....... The crypto space — together with its terminology, its protocols, projects, tokens, etc. — is a whole new exciting universe with new stuff to learn about every day. For me, it is frankly like being a kid in a candy store — or a mithai shop if you will — every day :) ........ We have intentionally planned out a continuously learning environment and an org structure to maximise learning, growth and impact. We will have teams in all major areas Coinbase works in today — infrastructure, cloud, platform, payments, crypto, blockchains, data engineering, machine learning, growth, product engineering — to name just a few. These teams in India will be led by local engineering directors, who will have large, independent and autonomous charters. ........... we’re hiring from all parts of India in order to find the best talent wherever they are or choose to work from in the country. We plan to complement this with physical offices in key cities as well to have a hybrid, flexible environment. In addition to the challenging and meaningful work, we also provide top tier perks and compensation, which allows us to ensure we have top talent in every seat across the company........... we’re introducing a new program called CIkka — short for “Coinbase India Sikka” — offering each new employee in India a one-time $1000 in crypto when they start ......... we dedicate 10% of our resources to supporting big product bets. .

Building a remote-first company: Our biggest lessons so far . Employees from other offices mostly visited San Francisco, not the other way around. Because of this, many employees in other offices keenly felt their distance from our San Francisco office, the de facto center of gravity for Coinbase. .......... after about a month of pandemic-induced WFH, we were willing to ask a big, deeply surprising, culture-shaking question: What if working remotely was … better? What if it actually had more advantages than being rooted to a single HQ? And after a month of grappling with that possibility, it became clear that we felt confident and convinced enough to say yes. .......... To get — and keep — top talent in every seat, as we scale. To help employees embody what it means to act like owners. To become the best crypto company in the world to work for. .......... Even as we grow, Coinbase works to preserve the founding moment. Part of that start-up energy we embrace is showing our work. When we announced to employees that we would be transitioning to remote-first, we had some early ideas about what it might look like ...... Coinbase still runs lean

; we all wear many hats, and are accustomed to jumping in to solve for the unexpected. .......... Sometimes, even if they weren’t ultimately the right choice, the conversation led us to the person who would be. ........ Done is better than perfect. ...... While the shift to remote work rightly feels revolutionary, it is also evolutionary. ........ being willing to question the way we do things, in order to do them better. ....... the psychological impact of going from an in-office world to one where an employee spends all of their waking weekday hours at home was tremendously challenging for many people ...... The next chapter, in which we fully inhabit our remote-first future — with some folks in the office five days a week, some a few days a week, and others never — is where the rubber meets the road, and where we can expect a whole new set of lessons to learn. .

Post COVID-19, Coinbase will be a remote-first company . After the restrictions of quarantine are over, Coinbase will embrace being “remote-first,” meaning we will offer the option to work in an office or remotely for the vast majority of roles. ........ Whether in an office or remote, being “remote-first” means we will all need to shift how we work. ........ I have come to believe that not only is remote work here to stay, but that it represents a huge opportunity and strategic advantage for us. ........... (almost) any employee who prefers to work outside of an office, can ......... for all of us, being remote-first requires a mindset and behavioral shift. It means that the employee experience should be the same, whether you’re in an office one day a week, five days a week, or never. .......... some employees are finding work from home to be a welcome change, and overall it’s been less complicated to transition than we would have expected. ........ an opportunity to have a hand in inventing the future of work.

........ I want us to choose innovation, and make our company an extension of the values of crypto. ...... there has been less operational complexity than we expected, and we believe there will be substantial strategic advantages in a mix of remote and in-office work going forward ......... A mix of in-office and remote work allows us to “de-risk” centralizing too much in a single location. ........ After a period of WFH, we think remote work (or part in-office and part remote) are options that many people, including the top talent we’re focused on hiring, will come to expect from employers. It also means we can capture top talent from all over the world. ...... We intend to offer remote work to all of our employees who want it, while maintaining the ability to work from an office for those who don’t. ....... Over time, the vision is to have one floor of office space in ten cities, rather than ten floors of office space in one city. ...... We’ll open up most new roles to remote candidates, and maintain a high bar for important skills like communication. ........ How can we make sure remote folks can get proper home set-ups? ...... can have team retreats and holiday parties again, our kids will be back in school, and we can see our friends ........ how we’re finding advantage in adversity

.

The Coinbase Secret Master Plan

Lessons from WhatsApp on international expansion

How crypto enables economic freedom .crypto solves many of the shortcomings of the current financial system that hinder economic freedom. ....... One question I often hear from employees is: “How does cryptocurrency create more economic freedom in the world?” ......... the government of any single country has significant control over the financial and economic freedoms of its people. Low economic freedom in a given country isn’t always due to malicious activity (e.g, fraud, oppression, etc) — it’s often due to mismanagement (poor monetary and fiscal policy) or simply bad infrastructure. .