NEOM, Jerusalem: Twin Cities?

My Take On NEOM, The City

NEOM: A City

What can NEOM do to enhance its chances of success?

(1) Wide Participation: Wider the better.

(2) $500 Billion Has To Be A Force Multiplier: If that $500 billion is the primary fund, it is obviously not enough money to build a city 33 times the size of New York City. NEOM has to feel like Europeans going to America, a land to give themselves a fresh start. And so techie gimmicks are not going to be enough. If you only have money and robots and cars and buildings, you could just end up with a white elephant.

(5) NEOM Needs Peace: There has to be peace between Israel and its Arab neighbors. The Palestine issue has to be resolved. Peace is the necessary precondition to prosperity anywhere.

(6) The Economic Viability Test: Cutting edge stuff can start in NEOM, but if they only stay in NEOM, if they can not be scaled to many parts of the globe, chances are that particular techie gimmick is not economically viable. Most stuff that is being dreamt for NEOM is going to have to pass that viability test. Otherwise, you just end up with a bunch of expensive failures. What that means is NEOM needs an active feedback loop that ties it to the rest of humanity.

(7) Attracting Top Tech Entrepreneurs: Can NEOM attract many of the top tech entrepreneurs of the emerging technologies? A defining quality of the golden era of Islam was an enormous thirst for knowledge. That thirst has to be brought back.

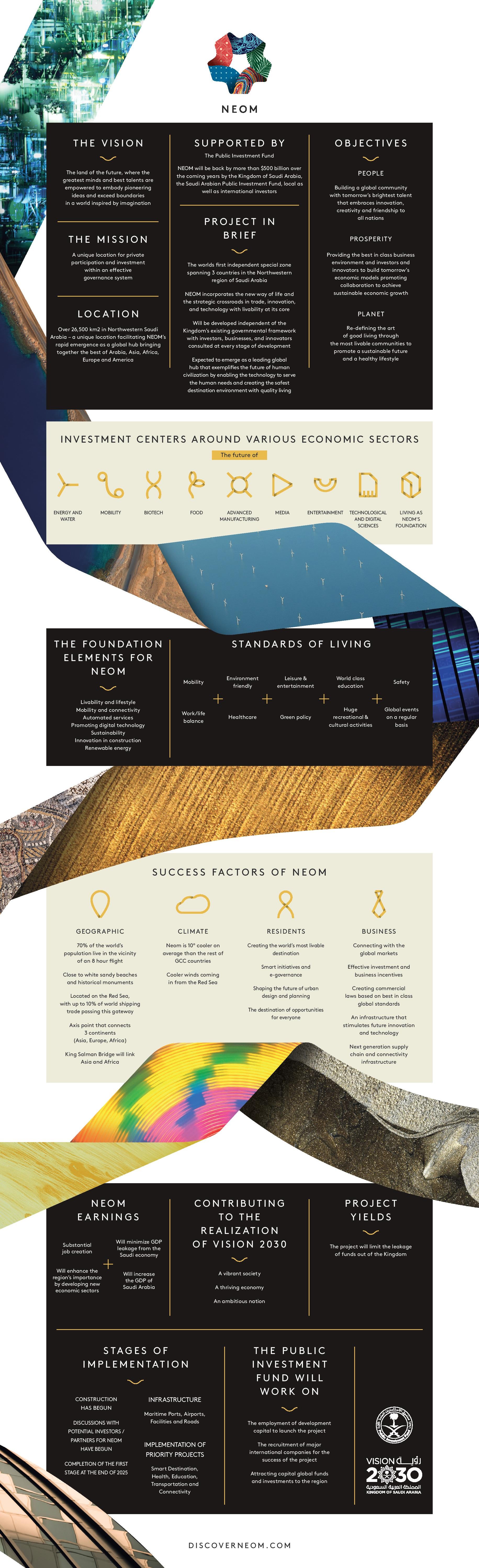

Saudi Arabia's NEOM: A US$500 Billion City Being Built 'For A New Way Of Living' Saudi Arabia’s Crown Prince Mohammed bin Salman announced on Tuesday the Kingdom’s most ambitious plan yet to free itself from dependency on oil. Prince Salman revealed a US$500 billion proposal to build a new transnational “independent special zone” on the Red Sea coastline that extends into Jordan and Egypt. Strategically located in proximity to international markets and trade routes, the 26,500 square km zone -dubbed as NEOM- is set to be powered by renewable energy, and has its eyes on incorporating elements of key sectors such as energy, advanced manufacturing, biotech, and media & entertainment........ will operate independently from the “existing governmental framework,” and is said to be funded by the Saudi government, its sovereign wealth fund, and local and international investors ....... Dr. Klaus Kleinfeld, the former Chairman and CEO of Alcoa and Arconic Inc. has been appointed as CEO of NEOM. “The NEOM project is set to transform the Kingdom into a leading global innovation and trade hub through the introduction of value chains of traditional and future industries and technologies to stimulate local industry, private sector job creation and GDP growth in the Kingdom” ........ The completion of the first stage of the project is expected to be by end of 2025, and its contribution to the Kingdom’s GDP is projected to reach “at least $100 billion by 2030.” It’s exciting times ahead for Saudi Arabia as the world watches how the Kingdom follows through on its ambitious economic and social upheaval plans.

I just read this phrase: "the world's first independent special zone." That is intriguing. Somebody said Catalonia has not been able to break away from Spain, but Saudai Arabia is voluntarily shedding NEOM! I think the idea of an independent city state is great. That will allow for maximum participation from numerous stakeholders. That is the only way to ensure success.

NEOM has to be able to compete with Dubai in terms of being able to attract people from all over the world. The number one quality I look for in any city anywhere is cultural diversity.

This is not just about technology. This is also about political innovation. And starting from scratch is the best way. May I suggest a few things?

All government services should be digital, and people should be able to vote on their phones, for a week. And anyone who has lived in the city for at least a year is automatically a voter.

Create a T100 along the lines of G20. These are the top 100 tech companies in the world as measured by market cap. They are given a Senate like space where to meet every year.

NEOM ought to have active ties with the 100 biggest cities in the world. In fact, build a Consortium Of Cities (CC). The mayors of the 100 biggest cities in the world meet here annually. To share best practices. To tackle big problems.

King Salman chooses staycation in Neom, Saudi Arabia’s new $500bn resort King Salman will avoid France this year to stay at the as-yet-unbuilt Neom, which artists’ impressions have labelled a City of the Future ........ When times are hard even Saudi monarchs are forced to forego the pleasures of the Mediterranean and opt for staycations......... King Salman, famed for the opulence and scale of his summer holidays in the South of France and Morocco, is staying this year in a new resort being built on Saudi Arabia’s Red Sea coast.

NEOM: Wide Participation Will Enhance Chance Of Success https://t.co/yiHngOE9uB @IsraeliPM @netanyahu @MustafaKheriba @JassimAlseddiqi @KingSalman @KSAmofaEN @RoyalSaudiNews @NEOM @ImranKhanPTI @narendramodi @iamsrk @aamir_khan @BeingSalmanKhan @saudiarabia @ksamissionun #NEOM

— Paramendra Kumar Bhagat (@paramendra) November 21, 2019

NEOM: Wide Participation Will Enhance Chance Of Success https://t.co/yiHngOE9uB @sundarpichai @satyanadella @Google @Microsoft @Apple @amazon @facebook @BillGates @JeffBezos @WarrenBuffett @MikeBloomberg @SadiqKhan @Benioff

— Paramendra Kumar Bhagat (@paramendra) November 21, 2019

Saudi Arabia's NEOM: A US$500 Billion City Being Built 'For A New Way Of Living' via @EntmagazineME @entmagazineme https://t.co/YSBn6Ermrc

— Paramendra Kumar Bhagat (@paramendra) November 21, 2019

In Abu Dhabi this week, the world committed $2.6B to #EndPolio. Thank you @MohamedBinZayed for your leadership in helping push this terrible disease to the brink of eradication. pic.twitter.com/7tr4wNQjRK

— Bill Gates (@BillGates) November 19, 2019

Why Israel is quietly cosying up to Gulf monarchies https://t.co/oGiu8Ev72N

— Paramendra Kumar Bhagat (@paramendra) November 20, 2019

The one thing missing from Saudi Arabia's dream city https://t.co/CyuYYWsX3A

— Paramendra Kumar Bhagat (@paramendra) November 20, 2019

/cdn.vox-cdn.com/uploads/chorus_image/image/59377089/wjoel_180413_1777_android_001.1523625143.jpg)