#Bitcoin is an apolitical fixed supply asset that is difficult for factions to change to their liking

— Zhu Su 🔺 (@zhusu) May 21, 2022

This is a feature, not a bug

If #bitcoin reduces the size of government that means it saves tax payers money which is why everyone who uses it should get a tax break.

— Dennis Porter (@Dennis_Porter_) May 21, 2022

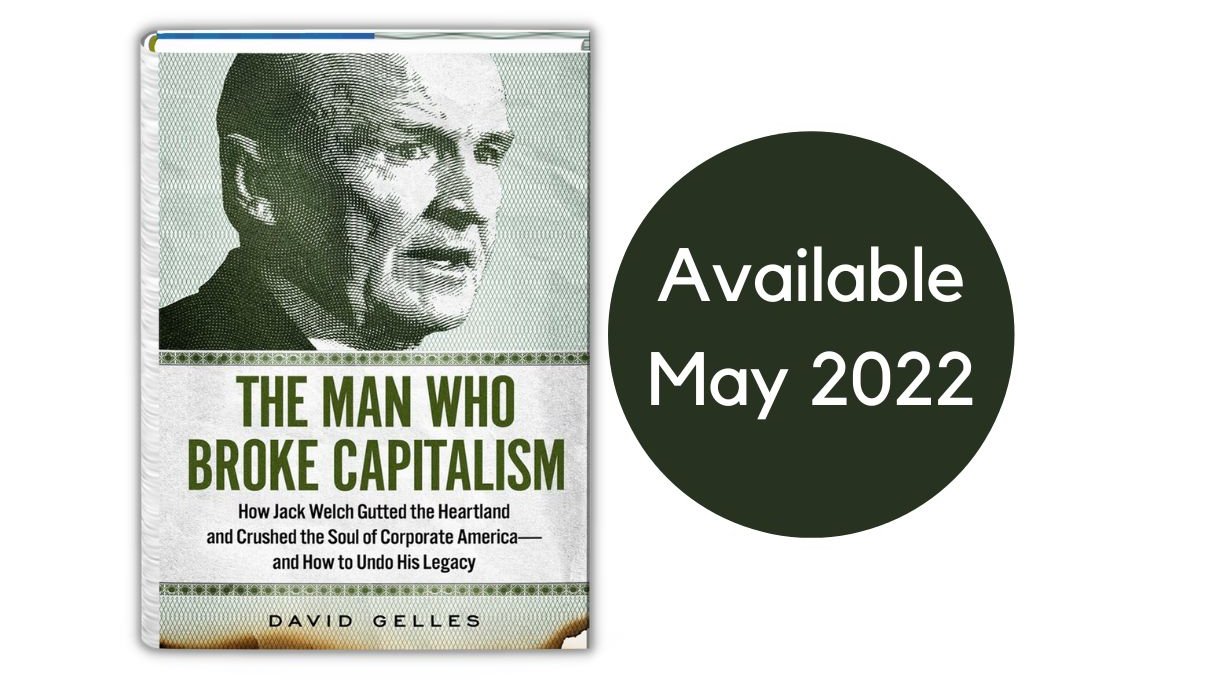

How Jack Welch’s Reign at G.E. Gave Us Elon Musk’s Twitter Feed The onetime ‘manager of the century’ paved the way for C.E.O.s to moonlight as internet trolls. ......... whom many revered as the greatest chief executive of all time. ........ David Zaslav, the C.E.O. of Warner Bros. Discovery and a Welch disciple, remembered him as an almost godlike figure. “Jack set the path. He saw the whole world. He was above the whole world,” Mr. Zaslav said. “What he created at G.E. became the way companies now operate.” ......... During Mr. Welch’s two decades in power — from 1981 to 2001 — he turned G.E. into the most valuable company in the world, groomed a flock of protégés who went on to run major companies of their own, and set the standard by which other C.E.O.s were measured. ......... “Manager of the Century,” as Fortune magazine crowned him upon his retirement. ......... he exerted a powerful and lasting influence on American business, informing how workers are treated, how shareholders are rewarded and how C.E.O.s comport themselves in an increasingly divisive age. When Donald J. Trump is elected president, when Jeff Bezos argues about inflation with the White House, when Elon Musk negotiates his $44 billion deal to buy Twitter by using the poop emoji — this is the world that Jack Welch helped create. ............ Mr. Welch still looms over the corporate world, living rent-free in the minds of C.E.O.s around the globe. ...... And in more than 100 conversations for “The Man Who Broke Capitalism,” my new book, from which this article is adapted, a broad range of people said some version of the same thing: While it has been more than two decades since Mr. Welch was C.E.O. of G.E., his legacy still affects millions of American households. Almost immediately after Mr. Welch retired in September 2001 with a $417 million severance package, G.E. went into a tailspin from which it would never recover. ........ His pupils, though, went on to run dozens of other major companies, including Home Depot, Albertson’s, Chrysler and Boeing. Most of them failed. ......... And in the decades since Mr. Welch assumed power, the economy at large has come to resemble his skewed priorities. Wages stagnated and jobs moved overseas. C.E.O. pay went stratospheric and buybacks and dividends boomed. Factories closed and companies found ways to pay fewer taxes. ........... Welch also redefined what it meant to be a boss, personifying an aggressive, materialistic style of management that endures to this day. .......... “Jack was the rock star C.E.O. of my era,” said Lynn Forester de Rothschild, one of the rare female media moguls of the 1980s. “We all thought Jack was doing everything right and that success was defined by meeting quarterly earnings to the penny.” ........ In retirement, Mr. Welch continued to hold sway over the business world as an elder statesman, penning books and columns, and appearing on cable news to praise the executives he had groomed and continue his assault on taxation and regulation. ........... Mr. Welch also pursued an unexpected retirement pastime: He became an internet troll. His old friend Donald J. Trump seemed to lead the way on many conspiracy theories that Mr. Welch embraced. But by 2012, Mr. Welch was picking fights of his own with his online adversaries, trying to own the libs on Twitter and promulgating conspiracy theories about the Obama administration. ............ a career defined by a ruthless devotion to maximizing short-term profits at any cost, and punctuated by a foray into misinformation. And it opened the door to an era where billionaire C.E.O.s are endowed with vast power and near total impunity. ......... G.E., too, is still reckoning with Mr. Welch’s legacy. For two decades after he retired, a succession of C.E.O.s tried and failed to return the company to its former glory. Then last year, G.E. management admitted defeat and made an announcement — the company would be broken up for good. ......... G.E. was worth $14 billion when Mr. Welch became C.E.O., just months after Ronald Reagan took office. Not long before Mr. Welch retired, just days before Sept. 11, 2001, the company was worth $600 billion, the most valuable company on Earth. ...........

the ways in which Mr. Welch created so much shareholder value often did more harm than good.

......... He wasa compulsive dealmaker, fueling G.E.’s growth with a relentless series of mergers and acquisitions

that took G.E. far from its industrial roots and set in motion a wave of corporate consolidation that would reduce competition in industries as diverse as airlines and media. .......... He closed factories and fired employees by the tens of thousands, unleashing a series of mass layoffs that destabilized the American working class. He devised systems like “stack ranking,” which mandated that the bottom 10 percent of workers be fired each year, and took root at other companies. And he embraced offshoring and outsourcing, sending labor overseas and turning to other companies to provide back-office functions like accounting and printing. .............. the nickname he hated but could never shake: “Neutron Jack,” a reference to the neutron bomb, which purportedly kills people while leaving buildings intact. .......... Welch’s obsession with finance that allowed him to steadily inflate G.E.’s valuation in the public markets. .......... By the time he retired, the company derived much of its profit from GE Capital, which was essentiallya giant unregulated bank. Mr. Welch called it “the blob”

— it was an amorphous, ever-changing collection of financial assets, capable of delivering whatever adjustments were most advantageous to the parent company in a moment’s notice. ............... The finance division became G.E.’s center of gravity, ultimately accounting for 40 percent of its revenue and 60 percent of its profit. With so much money coursing through the finance division, Mr. Welch used it to his advantage, shifting zeros throughout a sprawling international web of subsidiaries, and extracting whatever he needed to meet or beat analysts’ estimates for nearly 80 quarters in a row, an unprecedented run. It was what one influential analyst called “earnings on demand.” ................ the finance division was used to keep the stock price ticking up. ......... “There was very little transparency,” said Beth Comstock, a longtime G.E. marketing executive.@dgelles I was not aware of the Trump Welch connection. https://t.co/fGcmXPZQ79

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022

Let the stories pour forth. https://t.co/2mg3vh4ThT

— David Gelles (@dgelles) May 21, 2022

Schenectady, Erie, the list goes on. Full story in the book: https://t.co/v3wWvpsQ5U https://t.co/TfdmgBX93t

— David Gelles (@dgelles) May 22, 2022

That’s an amazing detail. The theme of hero worship — and why we shouldn’t worship our bosses — is a through line of the book: https://t.co/v3wWvpsQ5U https://t.co/eJWtvFc3xe

— David Gelles (@dgelles) May 22, 2022

Sharp stuff from @LaurenSHirsch https://t.co/MB8HVUlWrg

— David Gelles (@dgelles) May 21, 2022

That detail, along with MANY MORE CRAZY ONES, is in the book. Pre-order now! https://t.co/v3wWvpsQ5U https://t.co/Emdw8Bn8y9

— David Gelles (@dgelles) May 21, 2022

Thank you Joe! If I recall, you saw through this charade yourself when the gospel of Jack was still accepted dogma. https://t.co/8hD35JmFHJ

— David Gelles (@dgelles) May 21, 2022

This is an extraordinary project. Take some time with it. https://t.co/HNoxKb01QH

— David Gelles (@dgelles) May 21, 2022

Now we know why Haiti is poor. Also, Britain stole $45 trillion over 200 years from India. It is still stealing. From the world. All those offshore tax havens seem to be British territories. The thieves from the Third World send their money to London.

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022

Wells Fargo employees who said that they were instructed to interview “diverse” candidates — even though the decision had already been made to give the job to another candidate. great @FlitterOnFraud https://t.co/HEGwgPOokr

— Patricia Cohen (@PatcohenNYT) May 20, 2022

"This decision to fundamentally try to usurp a democratic government in Ukraine was absolutely a step too far. And the response internationally has been extraordinary, has actually made the West stronger than it was before Putin invaded," says @ianbremmer. https://t.co/2KQJkmilHh

— PBS NewsHour (@NewsHour) May 20, 2022

As we showed in "American Nationalist," Carlson has propounded variations of "replacement" -- a conspiracy theory originating among white nationalists and others on the far right -- in more than 400 episodes of his show. https://t.co/sjlXv2kf9k

— Nick Confessore (@nickconfessore) May 12, 2022

The US Supreme Court wanting to overturn Roe V Wade is the Supre Court buying into this idiotic replacement "theory." Produce more white babies, by force if necessary. That being said, I do want abortions to be rare, as rare as possible.

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022

Covid has killed almost 1 million people in the United States.

— Danielle Ivory (@danielle_ivory) May 14, 2022

Understanding who they were and how the country failed them is critical as the pandemic continues.

Each particle in our story represents a person who died.

It did not have to be this way.https://t.co/di1GAQnujx

The baby formula crisis is a monopoly problem, as @matthewstoller explains. https://t.co/hFhTEgrFVL

— David Gelles (@dgelles) May 13, 2022

There are few sectors of the US economy that don't have the lack of competition problem. America is no longer capitalism. But corporatism. You buy politicians and stiff the consumers.

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022

The monopoly problem has deep roots that go back decades, all the way to when Jack Welch was running GE and did more than 1,000 deals during his time as CEO, setting the stage for rampant consolidation across all industries. https://t.co/v3wWvpsQ5U

— David Gelles (@dgelles) May 13, 2022

That is a bold thesis statement.

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022

And thanks to Matt for generously blurbing my book. Preorder now: https://t.co/v3wWvpsQ5U pic.twitter.com/wkkMMLcgVK

— David Gelles (@dgelles) May 13, 2022

I wrote about what the Great Resignation has really looked like for workers. Almost everyone who quit has actually switched jobs. Most are in hospitality and retail. And they've raised their pay. What if it's actually a moment of huge ambition? https://t.co/l3o9rMrdDG

— Emma Goldberg (@emmabgo) May 13, 2022

2022 was expected to be a record year for solar installations in the US. But 64% of planned additions are now in jeopardy as the Commerce Department investigates solar imports and threatens tariffs, according to Rystad: https://t.co/FZMcYqhFKz pic.twitter.com/cLXz2esprB

— brad plumer (@bradplumer) May 12, 2022

"Slashing jobs, rampant dealmaking, outsourcing, financialization, and outsize executive compensation--all these trends became widespread only after Welch implemented them." @dgelles in 'The Man Who Broke Capitalism' on the destructive legacy of Jack Welch https://t.co/LTZOTwqoDn pic.twitter.com/beota3HzZP

— Simon & Schuster (@SimonBooks) May 12, 2022

This is extraordinary: The Pentagon praises @nytimes for its coverage of civilian deaths from US airstrikes, which just won a Pulitzer Prize.

— Cliff Levy (@cliffordlevy) May 12, 2022

"That’s what a free press at its very best does: it holds us to account and makes us think even as it informs.”https://t.co/Vi29hMdzkV pic.twitter.com/HGoLMndxBa

Oil giants like Shell and Total are selling off oil fields to help meet their climate goals — but some of them are being snapped up by private firms with laxer standards, leading to an increase in flaring and other environmental problems. https://t.co/p0xlXIuzPP by @HirokoTabuchi pic.twitter.com/XTJovMqv9t

— brad plumer (@bradplumer) May 10, 2022

Depressing story from @HirokoTabuchi about how oil giants sell off their unwanted polluting assets to companies with even looser environmental goals. The figure of flaring before and after sale is jaw dropping.

— David Ho (@_david_ho_) May 10, 2022

🎁 link: https://t.co/Q4H6GDbTXY pic.twitter.com/apkYHNeCxg

Big day for @nytimes: 4 Pulitzer Prizes. Scores of journalists across the newsroom contributed to these awards.

— Cliff Levy (@cliffordlevy) May 9, 2022

Truly a sign of the amazing range of Times journalism.

Huge congrats to the winners!https://t.co/QczJnRNgAD

Environmental groups looking to torpedo Quebec hydropower electricity transmission project into Maine. They've teamed up w/fossil fuel and nuclear plants to oppose additional clean hydropower from Canada. Of course, this benefits Putin. https://t.co/SU8SxBYArE

— Ryan Maue (@RyanMaue) May 9, 2022

Three energy companies that operate natural gas and nuclear plants spent $25 million on a campaign to kill a project that would have brought hydroelectricity from Canada to the U.S. https://t.co/xSE2wZ0RRy

— NYT Climate (@nytclimate) May 7, 2022

“Every market around the world is trying to deal with the same issue…trying to find ways to utilize as much of our renewable resources as possible…and at the same time make sure that we have enough dispatchable generation to manage reliability.” https://t.co/BuTAQWupNO

— Jeff Nesbit (@jeffnesbit) May 8, 2022

Always read @emmabgo https://t.co/OJd7cPJ0Ug

— David Gelles (@dgelles) May 8, 2022

Here’s my story from 4/29 https://t.co/iTsBXnbr2X

— David Gelles (@dgelles) May 7, 2022

Today @nytimes published a deeply reported story exploring the dual lives of Ed Koch, one of the most popular mayors in New York history and also a closeted gay man.

— carolynryan 🏳️🌈🏓 (@carolynryan) May 7, 2022

I’m in a cantina in Mexico City that has been flooded with shit after a rainstorm. My friend says he hasn’t seen this happen in 32 years. Climate change gonna be shitty.

— Gary Shteyngart (@Shteyngart) May 7, 2022

Elon Musk’s vision for twitter includes *very* aggressive growth over the next three years — we got ahold of his pitch deck to investors

— rat king (@MikeIsaac) May 6, 2022

here’s a breakdown of the numbers

w/ @LaurenSHirsch @PreetaTweets https://t.co/yG4McSTffx

The @19thnews team just keeps doing more and more important work. Inspiring. https://t.co/scpue9GSwg

— David Gelles (@dgelles) May 6, 2022

"It's good to see Welch finally cut down to size.” @jentaub on 'The Man Who Broke Capitalism' by @dgelles 💸 about the destructive legacy of #JackWelch

— Simon & Schuster (@SimonBooks) May 6, 2022

Coming 5/31: https://t.co/LTZOTwqoDn pic.twitter.com/96uYnLw1tC

Deeper look at Auxin by @ewesoff and @CanaryMediaInc. Questionable quality, questionable quantity, dissatisfied customers. https://t.co/meG7zTs907

— David Gelles (@dgelles) May 6, 2022

Here's my story about the situation, and a thread with more quotes from the Auxin CEO. https://t.co/Fv5UHL5u3k

— David Gelles (@dgelles) May 6, 2022

NEW: The story of how Nimbyism, Tucker Carlson, the Sierra Club and some fossil fuel companies banded together to kill a $1bn renewable energy project. https://t.co/UYBWyqg5wI

— David Gelles (@dgelles) May 6, 2022

"The Power of Big Oil" — our epic three-part docuseries investigating the decades-long failure to confront the threat of climate change and the role of the fossil fuel industry — is now streaming.

— FRONTLINE (@frontlinepbs) May 5, 2022

WATCH: https://t.co/iQx5uFk5rf pic.twitter.com/urYH5YYYSy

Boeing is just the start.

— David Gelles (@dgelles) May 5, 2022

Welch's fingerprints are all over our broken economy, and the work of undoing his profoundly damaging legacy is just beginning.

Much much more in my book, out May 31 and available for preorder now. END/ https://t.co/v3wWvpsQ5U

If you pooled a year's worth of oil and gas wastewater from the Permian Basin on top of Rhode Island, it would cover the state with 8.5 inches of water.

— Nicholas Kusnetz (@nkus) May 5, 2022

Send it underground, which is what's actually happening, and West Texas becomes earthquake central.https://t.co/cF0LtYtSjw

1/ Ann and I are thrilled to announce our collaboration with @Stanford to create its first new school in 70 years – The Stanford Doerr School of Sustainability. https://t.co/ftc2AiCrOR

— John Doerr (@johndoerr) May 4, 2022

Smart take on how corporate America is dealing the abortion issue by @emmabgo @LaurenSHirsch https://t.co/kzhrIL8X7z

— David Gelles (@dgelles) May 5, 2022

Thank you! Much metta to you all! cc @eamondolan https://t.co/7BicWMnPA8

— David Gelles (@dgelles) May 4, 2022

This is one of the largest gifts ever to an academic institution, second only to Bloomberg's $1.8 billion to Johns Hopkins.

— David Gelles (@dgelles) May 4, 2022

@dgelles You are a great curator. Just deep-dived into your Twitter stream. How would you like to collaborate on a book? It will be a book on corporate culture.

— Paramendra Kumar Bhagat (@paramendra) May 22, 2022