Returning to Riyadh last week for the latest Future Investment Initiative, known as “Davos in the Desert”, Mr Son was met by an almost-empty room for his panel discussion. The weary-looking billionaire, who at one point appeared to fall asleep, insisted he would keep offering capital to start-ups so they could “grow much bigger and quicker”.

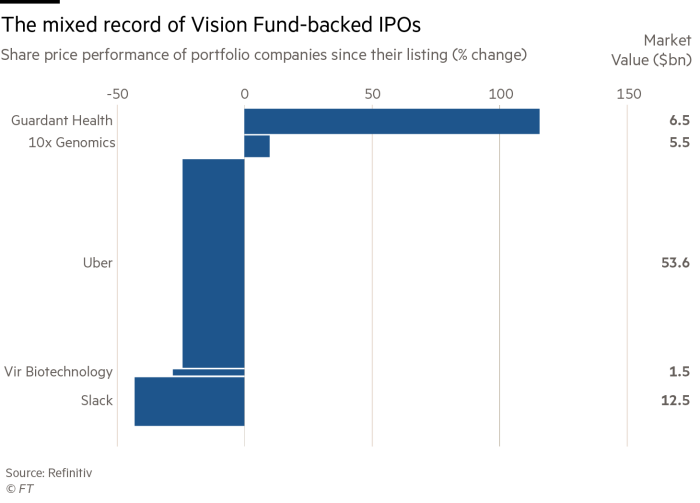

........ “We identify the entrepreneurs who have the greatest vision to solve the unsolvable,” he said. “They need to have the strongest passion. And then we provide the cash to fight.” ....... SoftBank shares have plummeted 26 per cent in the past three months. ......... The struggles have laid bare a sharp-elbowed culture within the Vision Fund, which is led by Mr Misra and seen as rife with mistrust, managerial disorganisation and clashes between executives. ......... Uber is now down 31 per cent from its listing price, with the Vision Fund sitting on more than $800m in paper losses since its investment. Other investments have suffered too: office messaging group Slack has dropped nearly 45 per cent since its first day of trading in June, while Vir Biotechnology has fallen 30 per cent since its mid-October listing. Only two Vision Fund-backed companies, Guardant Health and 10X Genomics, are trading above their IPO price.........One hedge fund investor says backing from the Vision Fund is “an immediate cue to sell”.

...... The steady procession of IPOs was intended to validate the Vision Fund’s late-stage bets and lay the groundwork for juicy returns that would make big-money investors clamour to pour money into its next Vision Fund. The group would look to list at least two portfolio companies per month by 2020, Mr Misra said earlier this year. ......... The biggest blow, however, came from a company whose founder Mr Son has praised and lavished with billions of dollars since 2017, saying it would be worth a few hundred billion one day. ........ The close bond between Mr Son and WeWork founder Adam Neumann had begun to sour long before its disastrous attempt to list in September. ........ “We created a monster,” Mr Son has told colleagues. “We gave him all the capital.” ....... “WeWork is not the only one weak asset,” says Atul Goyal, an equities analyst at Jefferies. “We suspect there are many such questionable investments or assets within SoftBank Vision Fund’s 80-plus investments.” ........ Other bets, such as a $500m investment into UK virtual simulation start-up Improbable, are not expected to generate any returns. Fair, the car subscription start-up that partners with Uber, recently revealed plans to cut 40 per cent of its workforce as it struggles to become profitable. Wag, the dog-walking company backed by a $300m Vision Fund cheque, has been earmarked for sale. ......... “Money in the right hands, right founders and right potential long-term platforms works,” saidNikesh Arora, Mr Son’s former heir apparent, who abruptly resigned in 2016

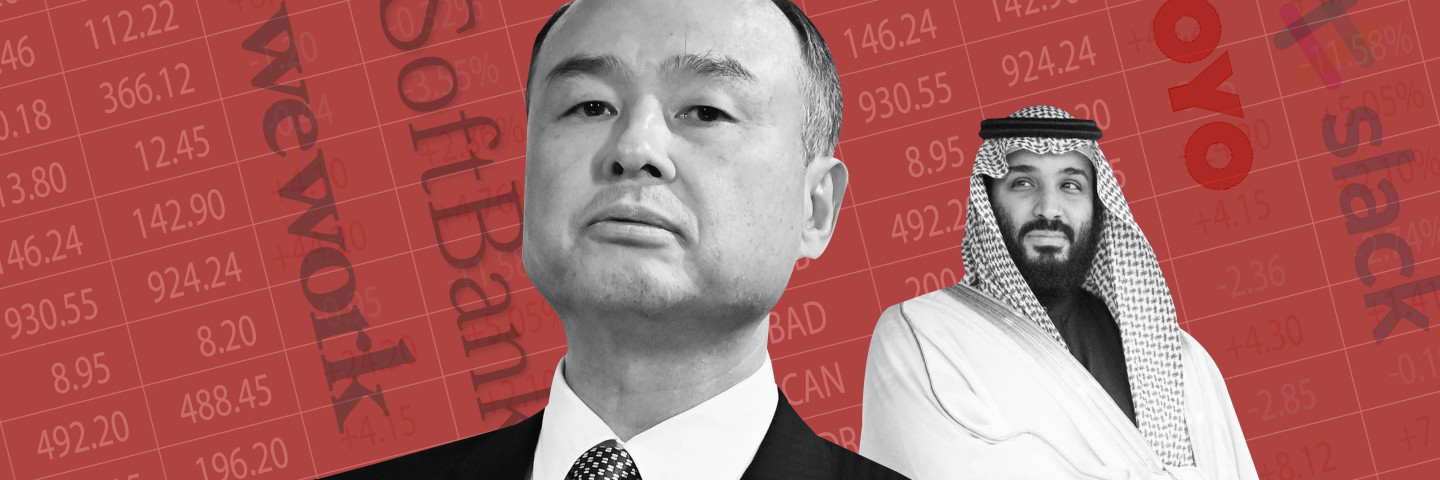

, at a CNBC event last week. “But it doesn’t work willy-nilly on every pet-walking and hotel room-renting website.” ....... It is hard to formulate a cohesive picture of SoftBank and the Vision Fund, in part due to Mr Son’s incessant dealmaking, and also because of the extreme levels of financial engineering employed by Mr Misra......... One of the most powerful credit traders from a pre-crisis generation of Wall Street bankers, the Indian former Deutsche Bank executive is considered by some as a pioneer of modern finance............ He was feted in April by Michael Milken, the junk bond king of the 1980s who was convicted of securities fraud and later imprisoned for two years. Talking to Mr Misra at a conference, Mr Milken, now a self-styled philanthropist, said: “There is no one that has the understanding of financial markets and capital markets and the hundreds of different types of instruments that you do.” .......... To others, however,Mr Misra is a source of chronic instability who has stuffed the senior ranks of the Vision Fund with former Deutsche Bank colleagues and financial complexity.

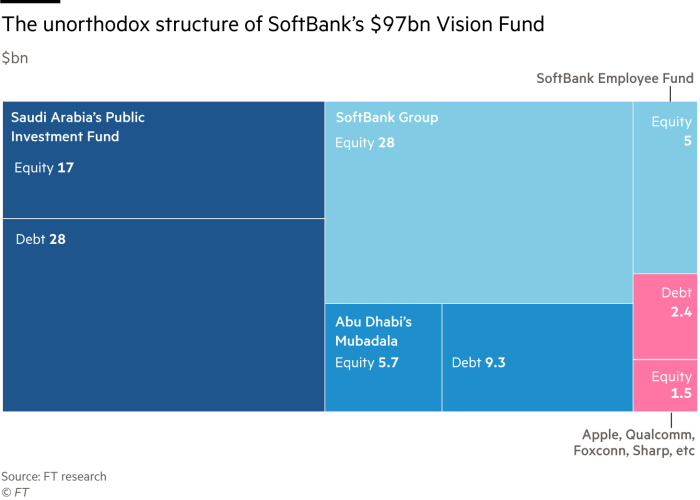

...... “SoftBank and the Vision Fund are layers of leverage upon leverage,” says one banker who has worked closely with both. This person and others see parallels to what took place at Deutsche Bank, the now struggling lender whose lack of oversight and controls saw its balance sheet laden with risky products of the sort Mr Misra specialised in. ...... SoftBank is saddled with $160bn of interest-bearing debt and its bonds are rated non-investment grade. The Vision Fund has a unique structure — created by Mr Misra — where roughly $40bn of outside investor funds are in the form of preferred shares that work like debt and pay an annual coupon......... When Mr Misra looked to return capital to the Vision Fund’s backers earlier this year, he added yet more leverage, taking out a $3.5bn loan mortgaged against stakes in companes including Uber. ....... Under Mr Misra’s watch, the fund’s ranks have grown to more than 400 employees ...... “I’ll tell you the biggest change in two years. We are learning so much. It’s becoming sixth sense. We transfer that learning to our portfolio companies,” Mr Misra told Mr Milken, highlighting best practices shared across its holdings. ....... The growth inside the Vision Fund belies an environment where Mr Misra and his allies have jostled with those outside their inner circle. Critics saythe toxic culture

, which Mr Son has overlooked, could imperil the future of the fund. ........... Two senior SoftBank executives have had fierce run-ins with Mr Misra that have had an impact on the balance of power in the Vision Fund and the company. One, Alok Sama, SoftBank International’s former chief financial officer who was a critic of the WeWork investment, left in April........ Former Goldman colleagues and others described Mr Schwartz as a “moral compass”, who became fed up with the changing culture within SoftBank and concerns over governance at the Vision Fund, as well as its reliance on money from Riyadh. ........ A second Vision Fund would help Mr Son silence his critics. A rollout this summer of those plans were designed to showcase SoftBank’s ability to attract blue-chip investors such as Microsoft. But no outside investors have formally signed up yet. ........ Nearly half of the $108bn SoftBank hopes to raise is set to come from the Japanese company itself and senior employees. However, some of these employees have balked at what that entails: a “loyalty test” that involves taking SoftBank loans equivalent to as much as 15 times their annual salary. ........... Executives within and close to SoftBank concede that renewed commitments from Saudi Arabia and its neighbour Abu Dhabi are crucial if there is to be a second fund. Both have been slow to commit, even as SoftBank executives are counting on Prince Mohammed to reinvest up to $30bn with them.Everybody has a bad year. Every person, every company, every country. Some have two, some have three. Is this just a bad year for Masa Son? I'd argue otherwise. If the idea for the 100B Vision Fund is to give a 2X return or a 3X return in a five-year timeframe, that would still be excellent. A 10X return over a 10-year run is considered excellent in VC circles. It is so good the vast majority of VCs fail trying. They go out of business.

But the expectations on Masa are high. People look at his track record. He is the magician who harvested big from his bets on Yahoo and Alibaba. If he were to pull the same rabbit out of the hat, the 100B fund should become 10T. Will it? I doubt it.

Masa bet big on WeWork and Uber. Those two moves expose his thinking with the 100B Vision Fund. He thought both those companies were out of high-risk territories. They had already found product-market fit, the holy grail of tech entrepreneurship. Now all they had to do was scale. To him, it was like that Russian billionaire pumping 100M into Facebook when Facebook was already hotcakes. It was on its way to up and up and up.

Now we know that is not how it panned out.

Either Masa will go back to his roots of doing early stage (which can't be easy .... that is akin to saying Mark Zuckerberg should go launch another Facebook ... Mark can't .... he is incapable of) or he might have to make do with more modest returns. Right now the 100B Vision Fund delivering a 10X return over a 10-year timeframe looks ambitious. As in, not happening. But even 2X would be nice. 3X would be great. 5X would be congratulatory stuff.

Prince Salman gets to tag along. :)