Twitter Board Diversity

How Do You Explain This? Brain Power?

Big Sitting Cash

Paul Graham's Social Essay

The Bernie Fuss

Taxation And Political Innovation To Less Inequality

The Planet? Or The Republican Party?

I believe Bill Gates has a pretty good program. He is getting billionaires to voluntarily give away money and prevent revolution. That is a great way to protect members of one's class.

On Bernie, I am just trying to understand what the guy is up to.

Economic Inequality

WTF?

Paul Graham “Clarifies” Again.

We need to, or voters and politicians need to, think of political innovation, and policy innovation the same way we think of technological innovation. What was 1776? Was that like launching Windows? What was it? Why did innovation stop at launching Windows? And who is responsible?

My Five Trillion Dollar Plan To Reduce Income Equality

How Do You Explain This? Brain Power?

Big Sitting Cash

Paul Graham's Social Essay

The Bernie Fuss

Taxation And Political Innovation To Less Inequality

The Planet? Or The Republican Party?

I believe Bill Gates has a pretty good program. He is getting billionaires to voluntarily give away money and prevent revolution. That is a great way to protect members of one's class.

On Bernie, I am just trying to understand what the guy is up to.

Economic Inequality

Since the 1970s, economic inequality in the US has increased dramatically. And in particular, the rich have gotten a lot richer. ....... by definition, if a startup succeeds its founders become rich. Which means by helping startup founders I've been helping to increase economic inequality. If economic inequality is bad and should be decreased, I shouldn't be helping founders. No one should be. ........ How can economic inequality not be bad? Surely it's bad that some people are born practically locked into poverty, while at the other extreme fund managers exploit loopholes to cut their income taxes in half. ...... economic inequality is not just one thing. It consists of some things that are very bad, like kids with no chance of reaching their potential, and others that are good, like Larry Page and Sergey Brin starting the company you use to find things online. ........ if you actually want to fix the bad aspects of it—you have to tease apart the components. And yet the trend in nearly everything written about the subject is to do the opposite: to squash together all the aspects of economic inequality as if it were a single phenomenon. ....... critical aspects of inequality, like the role of technology in wealth creation ......What Paul Graham Is Missing About Inequality

the pie fallacy: that the rich get rich by taking money from the poor.

...... multiple ways people become poor, and multiple ways people become rich ....... Before Mark Zuckerberg started Facebook, his default expectation was that he'd end up working at Microsoft. The reason he and most other startup founders are richer than they would have been in the mid 20th century is not because of some right turn the country took during the Reagan administration, but becauseprogress in technology has made it much easier to start a new company that grows fast.

.......... there are a lot of people who get rich through rent-seeking of various forms, and a lot who get rich by playing games that though not crooked are zero-sum, there are alsoa significant number who get rich by creating wealth

......... variation in productivity is accelerating.The rate at which individuals can create wealth depends on the technology available to them, and that grows exponentially.

The other reason creating wealth is such a tenacious source of inequality is that it can expand to accommodate a lot of people. .......... as long as you leave open the option of getting rich by creating wealth, people who want to get rich will do that instead. ....... Most people who get rich tend to be fairly driven. ....... determination is the main factor in the success of a startup ...... a lot of the new startups would create new technology that further accelerated variation in productivity. ....... Variation in productivity is far from the only source of economic inequality, but it is the irreducible core of it, in the sense that you'll have that left when you eliminate all other sources. ....... Startups are almost entirely a product of this period. And even within the startup world, there has been a qualitative change in the last 10 years. Technology has decreased the cost of starting a startup so much that founders now have the upper hand over investors. Founders get less diluted, and it is now common for them to retain board control as well. ........The acceleration of productivity we see in Silicon Valley has been happening for thousands of years. If you look at the history of stone tools, technology was already accelerating in the Mesolithic.

....... The evolution of technology is one of the most powerful forces in history. ...... an exponential curve that has been operating for thousands of years, I'll bet on the curve. Ignoring any trend that has been operating for thousands of years is dangerous. But exponential growth especially tends to bite you. ....... And to get rich now you don't have to buy politicians the way railroad or oil magnates did. The great concentrations of wealth I see around me in Silicon Valley don't seem to be destroying democracy. ....... a good number are merely being sloppy by speaking of decreasing economic inequality when what they mean is decreasing poverty. ...... Closely related to poverty is lack of social mobility. I've seen this myself: you don't have to grow up rich or even upper middle class to get rich as a startup founder, butfew successful founders grew up desperately poor.

....... There is an enormous difference in wealth between the household Larry Page grew up in and that of a successful startup founder, but that didn't prevent him from joining their ranks. It's not economic inequality per se that's blocking social mobility, butsome specific combination of things that go wrong when kids grow up sufficiently poor.

........... let's attack poverty, and if necessary damage wealth in the process. That's much more likely to work than attacking wealth in the hope that you will thereby fix poverty ....... if there are people getting rich by tricking consumers or lobbying the government for anti-competitive regulations or tax loopholes, then let's stop them. Not because it's causing economic inequality, but because it's stealing

It is good that Paul is wrestling with the question of income inequality, as Silicon Valley as a whole should be. ..... We have to understand what’s wrong with the world as it is, because only then can we envision the world we want to create, and think about how to get there. ....... we need to take a closer look at how one of Silicon Valley’s most treasured tools for creating wealth for employees — the stock option — has played an unexpected role in increasing income inequality. ...... even Thomas Piketty argues that

increased productivity and better diffusion of knowledge create more wealth for society and are among the forces that reduce income inequality.

........ on average, one group of people is becoming significantly richer, while another is becoming significantly poorer ...... the growth of the financial industry is central to the inequality discussion. ..... Financial markets have been extracting a larger and larger slice of the entire economy. ...... Around the turn of the century, financial markets provided capital to business and consumers at a cost of about 2% of the total economy. By 2013, that cost was up to 9%! (By contrast, the entire internet sector is about 5% of GDP!) ...... the size of the financial sector has increased at the same time as the role it plays in financing innovation and productive investment has decreased! ......I think you have to ask yourself how much this “financialization of the economy” is also a major contributor to the Silicon Valley wealth that you celebrate in this piece.

........ Google increased US economic activity in 2014 by $131 billion dollars. That means that value created for other businesses in 2014 was more than double Google’s own $61 billion in annual 2014 revenue. (Note that the value creation number from Varian’s study is US only, while the revenue figure is worldwide.) Given that Larry and Sergey founded Google in 1998, you can count the cumulative economic impact in the trillions of dollars. And the consumer surplus provided by free access to vast amounts of online information has to be far larger. .......... As long as the startup creates more value for society than it takes out for itself, it can actually decrease inequality, rather than increasing it. ....... those services did indeed result in increased revenues for those 1.8 million Google business customers. As for the users of the Google search engine, we also participated in an exchange of real value, receiving free search services, navigation, office applications, and much more, in exchange for clicking on some of the advertisements that those paying Google customers placed via the service. ........Financial markets are very different than the market of goods and services

....... The price of a stock is fundamentally a bet on the future. ...... When a company fails to deliver value that lives up to that bet, but still cashes in through IPO or acquisition, the wealth that is gained by startup founders and early investors is taken from public market investors. This is a risk that both sides of the bet willingly take, and it has provided enormous fuel for innovation as it encourages innovators to take risks in hope of future rewards. But in over-excited markets, it’s too easy for many startups to aim to cash out with “dumb money” while the getting is good with no real plan for ever delivering real revenues or profits. ......... As it turns out, the value that Larry, Sergey, and other early insiders have realized from Google through financial markets roughly matches the share of Google’s profits they could have claimed as owners of a private company. But that isn’t always the case. ....... financial markets have increasingly gone from being a source of capital for companies to a kind of giant betting pool, in which winning and losing is much less correlated with underlying economic activity. ...... In an economy where financial instruments are increasingly unmoored from the real market of goods and services and profits derived from those services, it’s possible for many people to reap rewards that weren’t actually earned. I’m not just talking about bubble-inflated stock-based compensation that has made many people in Silicon Valley so rich, or the excesses of Wall Street banks which nearly wrecked the economy in 2008, but the entire structure of executive compensation. .........stock options, which have paid such a large role in Silicon Valley wealth, have been misused, and have become a key part of the problem of income inequality.

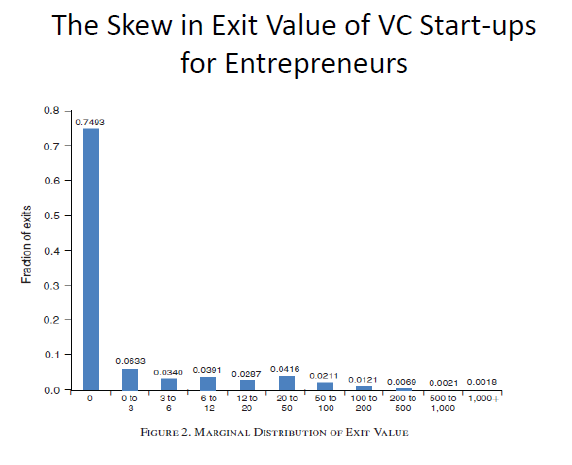

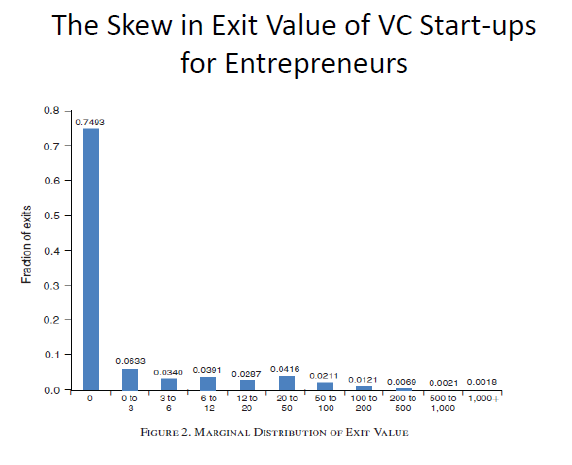

...... in 75% of VC-backed start-ups, the entrepreneur gets zero. If becoming rich in Graham’s world means making $100 million (pre-tax), then 0.4% of entrepreneurs make the grade. .......... It reached the destructive extreme when the CEOs of banks, whose liabilities are guaranteed by taxpayers, began getting most of their compensation in options. ..... “Starting in the 1970s and accelerating in the 1980s, most CEOs and other top executives began to receive the bulk of their compensation in stock options, rather than as ordinary income. And in 1993, a well-intentioned law pushed by President Clinton limited the ordinary income that could be paid to top management, with the unintended consequence that even more of the compensation moved to stock options. The intention was to align the interests of management with the interests of shareholders, but is often the case, those good intentions were derailed by poor implementation. ......... Congress allowed a huge loophole in the accounting treatment of stock options — unlike ordinary income paid to employees, value paid through options need not be charged against company earnings. It is thus a kind of “free money” for companies, invisibly paid for by dilution of public market shareholders (of whom a large percentage are pension funds and other institutional shareholders representing ordinary people) rather than out of the profits of the company. As a result, executive compensation soared, to the point thatin one outrageous 1999 case, the CEO of retailer Abercrombie and Fitch received $120 million in option pay (not charged to the P&L), while in the same year, the company had only $150 million in earnings

........... Meanwhile, there is an incentive to cut income for ordinary workers, because that still shows as an expense on the P&L. Cutting wages drives up net income and thus the price of the stock in which executives are increasingly paid. ....... there are strong incentives for financial maneuvers like stock buybacks, which too often replace productive re-investment in the underlying business ......the use of stock options and other financial instruments led to a widening gap between the pay of executives and ordinary workers. In the 1960s, CEO pay was 20x that of the average worker. Now, it is 300x that of the average worker. This is a major driver of inequality.

...... Silicon Valley companies are actually better than many other companies, because they offer options to virtually every employee, but even there, those options are overwhelmingly weighted towards top management, with each lower rank of workers typically receiving a full order of magnitude less in value. ....... In the case of companies like Walmart and Amazon, productivity gains may also be given to consumers in the form of lower prices, as a way to expand the market share of a business. Or in the case of Google and Facebook, given to consumers as free services, paid for by advertisers. ......we have forgotten the hard fought lessons of the 20th century, that workers are also customers, and that unless they receive a fair share of the proceeds, they will one day be unable to afford our products.

...... when we saw that many members of society were no longer able to afford the products our companies have on offer, we encouraged workers to borrow money at high credit card interest rates so that they could maintain the illusion of middle class wages, and even encouraged them to take on student debt so that they could retrain themselves for the jobs of the future that we were busy stripping away. And of course, when the government stepped in with a safety net to support those who could no longer afford even the bare necessities of life, businesses gratefully accepted the economic boost from their spending of government benefits, but claimed that those we no longer paid enough to live without that assistance were freeloaders. ........ the way that we allocate profits from increased productivity to top managers versus ordinary workers, or the way that our tax system favors capital gains over income earned by labor ..... You have to ask yourself, though, whether a Silicon Valley startup is more like the woodworker who made five chairs, or more like the high frequency trader. It’s clear that many startups are like the woodworker, but in bubble times like these, there are a lot of startups that are more like the high frequency trader. ...... we’ve figured out how to have machines make many of the products that we used to pay people to make. And we’ve figured out how get people on the other side of the world, in countries that are much poorer than ours, to accept much lower wages and much worse working conditions as a way to increase the profits of our businesses. ....... Doing this has actually increased the wealth of people in those other countries — income inequality has decreased worldwide, with fewer and fewer people living in abject poverty, and hundreds of millions of others beginning to enter the middle class. But in formerly rich countries, many people who used to be paid well for their work now have to compete for lower-paid jobs, while those who already own meaningful capital take a larger and larger share of the pie. .......... All it takes to increase income inequality is for there to be more companies practicing the “degenerate case” than practicing the virtuous kind of capitalism that creates more value than it extracts. ........ If you couldn’t successfully analyze a situation with statistics, half of the internet startups you celebrate wouldn’t exist! ..... If you’d spent as much time talking to people who work at today’s low-wage jobs, you might have a very different perspective. ....... you underestimate the increased role of financial markets in how entrepreneurs are compensated, so that even many companies without real profits can reap enormous stock gains. You have to realize that Zuck, like Larry and Sergey, is an outlier, in that he created an extraordinarily profitable business. .......When a startup doesn’t have an underlying business model that will eventually produce real revenues and profits, and the only way for its founders to get rich is to sell to another company or to investors, you have to ask yourself whether that startup is really just a financial instrument, not that dissimilar to the CDOs of the 2008 financial crisis — a way of extracting value from the economy without actually creating it.

...... I call today’s economy “The WTF Economy.” It fills us with wonder, and it fills us with dismay. I’ve been working hard to understand what we need to change if we want to create a Next Economy that will preserve the wonders of innovation but also addresses the dark futures that we face unless we put people first. Let’s work together to harness the power of technology to decrease income inequality rather than increase it!

WTF?

the entire internet economy, which does not all belong to startups, is 3.4% of GDP

Paul Graham “Clarifies” Again.

The median US household net worth is about $80k. ...... It’s common for the stock of a successful startup founder to be worth a hundred times as much, and not unheard of for it to be worth ten thousand times as much. ..................... To continue with my global warming analogy, no one gives a damn about one or two fires. Or even a thousand. They care about the planet’s temperature. ...... the aggregate measurement of “economic inequality” is no more influenced by wealth of any individual tech millionaire — even Bill Gates — than global warming is by one really, really hot fire somewhere. ..... a fire is a lot hotter than the much more ample air around it — not that that thing influences the planet’s temperature as a whole. ...... The successful ones do well. It is completely, radically, insanely uncommon for any tech founder’s stock to be worth a hundred times as much. The successful ones are, yes, successful. Most of them are not. Just like every other job. ...... Maybe you think Tech is good, and therefore tech millionaires are A-OK in your book (I would agree with you). ...... On the Forbes 400 richest people in the US list — the very one Graham mentioned: thirteen percent of the richest people (53) in America made their money in tech. The share of people who made their money via investments (aka hedge funds and the like), by comparison, is 24%. .......Tech Startup Equity Distribution

those tech billionaires on the Forbes 400 control $515 billion between them. The top 1% of the United States controls just shy of twenty eight trillion dollars.

The Forbes 400 as a whole controls around $4 trillion. ....... There aren’t enough tech millionaires out there to make much of a dent in economic inequality. .......How many millionaires has tech made? A million? Not even close. How many millionaires are in the United States? More than six million (and I am using the conservative definition, which excludes primary residences).

....... You know how many millionaires there are in California? 777,000. But most of these aren’t tech millionaires. Los Angeles, being the 14th largest population of millionaires in the world, has 126,000 of them. San Francisco doesn’t even make the list. ........The startup world could triple the number of millionaires it has made, and it would still be a drop in the bucket when it comes to economic inequality.

....... Microsoft made 12,000 millionaires. Google made 1,000. Facebook made 1,000 (to be fair,they’ve probably made one or two thousand more since their stock is killing it). Twitter made 1,600. Atlassian has made 100. I worked at a unicorn. It sold for a billion plus. I’d be shocked if it made more than 20. ........ Wonder where all that money went. Oh right. The VCs. And the 2 or 3 co-founders. ......Every single person on that Forbes 400 list from tech was a founder, co-founder or a VC. Not a single early employee among them.

...... San Francisco isn’t in the top 20 cities on earth for millionaires. Or multi-millionaires. But you know what list it is on? Billionaires. San Francisco on its own, ignoring the rest of Silicon Valley, ranks #16 in the world for billionaires. ....... Tech startups are great, sure. But they have nothing to do with economic inequality. The funding structures of startups do. ............. The more you think about it, the more you realize that Paul Graham is trying to claim that startups are essential to our society (agreed) and the only way people will build startups is if we do it exactly as we do right now, and the top three people in a startup can get super super rich, like global elite rich, and everyone else in the company doesn’t. ....... It seems to me that people will still start just as many startups with less economic inequality in the world, just like they have in the past. ....... how upset the 99% of the Bay area would be if tech IPOs still made the number of millionaires as they did with Microsoft.

We need to, or voters and politicians need to, think of political innovation, and policy innovation the same way we think of technological innovation. What was 1776? Was that like launching Windows? What was it? Why did innovation stop at launching Windows? And who is responsible?

My Five Trillion Dollar Plan To Reduce Income Equality

- Put one trillion into solar.

- Put one trillion into physical infrastructure: roads, bridges, drones for broadband, schools, hospitals.

- Put one trillion into microfinance for people who can not offer collateral. Collateral is stupid.

- Put another trillion into solar.

- Give one trillion to a world government. On 1% interest. Do the Bond thing. Money is growing. Why are you complaining?